Author: Lasha Arevadze

The article was writen in the framework of the project "Strategic Plan Georgia 2020 - Strengthening Public Involvement" and was published on the blog "Georgia 2020".

From “Washington Consensus” to Inclusive Growth

The prominence of inclusive growth, reflected in the Social-Economic Development Strategy - Georgia 2020, can be thought of as a mirror-image of the debates among academic and policy makers. In principle, ‘Georgia 2020’ presents classical arguments against those, who emphasize the [significance] of economic growth. The authors of the strategy highlight the fact that, despite the economic growth, inequality has not been reduced.

The economic policy of the last decade was close to the paradigm, known as the Washington Consensus that emphasizes the macroeconomic stability and the facilitation of private investments by implementing massive infrastructural projects, followed by economic growth. According to the logic of Kuznets, the economic growth will lead us to overcoming the problem of inequality, as J. F. Kennedy would say “a rising tide lifts all boats” [2]. During the 1990s, the logic of Washington Consensus lost its dominance. The scepticism towards it was related to its mostly theoretical character. It was also due to the fact that so-called “industrial policy”, rejected by the Washington Consensus, proved to be successful in numerous cases: South Korea, Hong Kong, China, etc. Washington Consensus was also cut off from the World Bank’s economic policy and today the paradigm of the so-called “Inclusive Growth” has become prominent.

Why did inclusive growth become prominent? While discussing this topic, number of issues require deep analysis. What does inclusive growth mean? Is it the concern over the income of the poor? At least, it can be said that the objective of inclusive growth is to promote productive employment. Is Inclusive growth important, because poverty is not “desirable”? Or is it because future economic growth will be at risk? To what extent does economic growth guarantee the reduction of poverty and inequality? As it is evident, the the spectrum of issues is quite broad. First of all, in order not to create false expectations and to assess the challenges facing Georgia in this respect, we need to start discussions on these issues to determine why the paradigm of inclusive growth, internalized by ‘Georgia 2020’, became so prominent.

According to the assessment of the World Bank (WB), economic growth is indisputably important to reduce poverty. However, in order for the growth to be sustainable, it should secure a broad involvement of the work force in the process. Inclusive growth means the improvement of conditions of poor not through redistributive policy, but through their involvement in the economic activities.

The scepticism toward Washington Consensus started with the interpretation of empirical data, which illustrated that poverty and inequality were not reduced in line with economic growth. These circumstances were hindering the long-term economic growth, and therefore, the question was raised whether or not inequality was a factor of slow economic growth. As several researches indicate, inequality can cause low economic growth in terms of asset-ownership (ex. land). Still, why would inequality cause slow economic growth? First explanation is a political one. More specifically, the higher the inequality, the more people choose the political power, whose statements and policies are directed towards allocating the income from taxes in a way that reduces the desire and number of investments, leading to slow economic growth.

The second explanation as to why economic inequality can slow the pace of economic growth, relates to credit market. More specifically, if assets are not allocated equally and economic activities require collateral, because poor population does not have enough assets for collateral to start economic activities or get education, this will lead to low level of economic involvement to create goods and less economic growth. Yet, to what extent is it justifiable to change the situation by redistribution of assets?

On the contrary, as numerous research illustrate, the positive result of resource allocation policy is much weaker for poor people than negative effect by the reduction of investments by relatively rich actors (Effectively, this is the experience of Zimbabwe, where the reallocation of land from large landowners to the farmers with smaller land was followed by the drop in production, hyperinflation and complete collapse). In the end, the most proper strategy to reduce inequality and to achieve high economic growth is to increase [the number of] productive assets. This is achieved by accumulating similar assets, such as investment in human capital. Major postulate of inclusive growth is in fact the increase in productive employment.

There are two different approaches as to what should be the objective of economic policy in terms of increasing the income of poor population. Firstly, to decrease inequality and increase their income special programs are needed. Second, those who acknowledge the existence of Kuznets curve, consider that the main emphasis should be on economic growth.

When the industrial sector - which is more productive than agriculture - starts developing in the country, the relative income of those employed in agriculture decreases, leading to migration from rural to urban areas, where the income distribution is less equal. Therefore, inequality grows. In the end, inequality decreases with the economic growth. “Kuznets Curve” scenario proves that the economic growth leads to reduction of inequality. What’s more, as A. Kraay and others illustrate, economic growth leads to increase in income of poor with the same pace and according to the empirical data, the increase in income of poor does not lag behind the economic growth. Furthermore, the so-called cornerstone of liberal policy - stable fiscal and monetary policy [and] small government increases the share of low-income individuals in the overall income.

Significant time and energy of researchers has been spent on checking Kuznets’s logic and ultimately, we see he results in cross-sectional analysis (if we take data from all the countries in a specific time-frame and will study relation between income and inequality) showed that the logic is plausible. However, this theory is powerless in terms of explaining the direction of evolutionary development between inequality and income within countries based on historic data.

For instance, the analysis [4] of IMF researchers illustrates that inequality has a negative effect on economic growth and its duration. They also reviewed Okun’s observation, that states that if inequality (hampering economic growth) is resolved via redistribution, it has much worse consequences on economic growth than the inequality itself. They empirically illustrated that Okun’s theory is valid only in extreme cases, when the redistribution policies significantly change Gini coefficient [5] (by 0.13). In other cases, redistribution is neutral in relation to economic growth.

Finally, even the ambiguity around Kuznets curve, in other words the notion that economic growth does not immediately lead to reduction of income inequality and that inequality threatens the process of economic growth, led to revitalization of the inclusive growth paradigm.

Where is Georgia in terms of inclusive growth?

Evidently, the main message of “Strategy 2020” is to promote inclusive growth. As there is no consensus on its definition, it is an arduous task to find adequate evaluation indicators, however the methodology proposed by the WB during the World Economic Forum in 2015 in Davos can be considered to be one of the best in this regard.

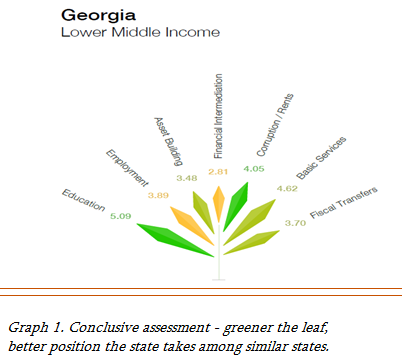

It is not surprising that inclusive growth can be succinctly defined as an increase in productive employment. To achieve this objective, number of indicators must be accomplished. For instance, according to the methodology formulated by the World Economic Forum, achievements in pursuit of inclusive growth can be categorized in 7 groups [7], which in itself include number of sub-indicators: 1) Education and Skills; 2) Employment and Labour Compensation, 3) Asset Building and Private Property, 4) Corruption and Rents, 5) Basic Services and Infrastructure, 6) Financial intermediary investing in real economy, 7) Budgetary Transfers.

It is interesting to assess what progress Georgia has attained according to the logic of inclusive growth up until today. In my regard, these assessments point more to the economic problems that Georgia is facing today.

One of the main pillars of “Strategy 2020” is level of entrepreneurship. In this regard, it is interesting to see the results of inclusive growth report. In this indicator, Georgia is 10th among low and middle income countries (total number of countries 38), it is also 21st in terms of fulfillment of contract. As for protection of preoperty rights, Georgia is on the 15th place.

Special scrutiny is required for the part on financial intermediation, which ranks Georgia on 16th place among low and mid income states. Georgia is on the 31st place among states with the access to business accounts for the poorest 40% of the population. In terms of access to credit, it ranks 23rd. Georgia is in the middle in terms of accessibility of financial sector. The situation is even worse in case of financial intermediation of real economy investment (19/38). In terms of accessibility of local asset market, Georgia takes 34th place among 38 low and middle income states, as for attracting venture capital, Georgia is on 32nd place.

The main objective of inclusive growth is the facilitation of productive employment and based on it, achieving broad economic growth. As in case of financial intermediation, Georgia has significant gaps in this component among the states of the same group (24th place). The indicator of employment, youth employment and self employment is below the average. Georgia ranks 24th in terms of maintaining talent and 26th in terms of employing individuals below the poverty line. In this section, Georgia ranks the best for legal economic activities - it is the best among its peers in the group.

Overall, Georgia has a good position in terms of level of corruption, 5th among 38 countries. However, there are shortfalls in certain categories, for example, trust towards politicians (18th place). At the same time, Georgia’s success in terms of fighting corruption is exemplary (1st place on the list). The biggest shortfall is in terms of rent concentration (34th place). In terms of market concentration and competitiveness Georgia is 25th and 26th respectively. As concentration of banking sector assets, Georgia is 31st (among 35 countries) in this respect.

Despite everything, Georgia ranks 4th in terms of education and skills (after Ukraine, Moldova, Thailand). The indicator is unsatisfactory in terms of educational expenses (24th place from 2.71% GDP). Despite the fact that unemployment is one of the major challenges for Georgia, it is hard to find a qualified workforce. According to this indicator, Georgia ranks 35th, indicating that the problem of qualification is the most severe among the challenges to economic growth, and highlights problem in quality of education system in educational system.

In terms of social welfare, Georgia ranks 7th. However, it is not advisable to rely on this indicator to discuss current situation, since the assessment relies on the data provided before 2012.

The objective of classifying the groups is to show the level states hold among the peers from the same income group, and therefore highlight the issue that needs to be addressed. The assessment from Davos Economic Forum sends important messages: firstly, Georgia is not on leading position among low and mid income states according to the multi-component assessment of economic growth. Despite some success in eradicating corruption and providing access to education, the major challenge remains to be underdeveloped financial markets, access to credits, low quality of education, market concentration, mechanisms for contract enforcement, protection of private property, etc. The assessment is important as it indicates the gaps among the states having similar income. Hence, problematic is not only “catching up” with high income states, but also it is important to advance in the existing group.

There are different assessments as well, for instance, according to chief economist of UNDP - economic growth is inclusive if it “ occurs in places where the poor live; uses the factors of production that the poor possess (e.g. unskilled labor); and reduces the prices of consumption items that the poor consume (e.g. food, fuel and clothing).”[9]. Let’s discuss these propositions in detail:

From 2012 to 2014, output in agriculture increased by 20% (while the total economic growth was 8%). However, it is impossible to attribute this growth to the policy of inclusive growth, as in 2014 growth in agriculture was only 5% and in 2010-2011, growth in agriculture was 16%. This only points to the fact that production in agriculture is low and in absolute terms it is difficult to maintain the growth trend, which implies that sustainable growth is absent in this sector as well.

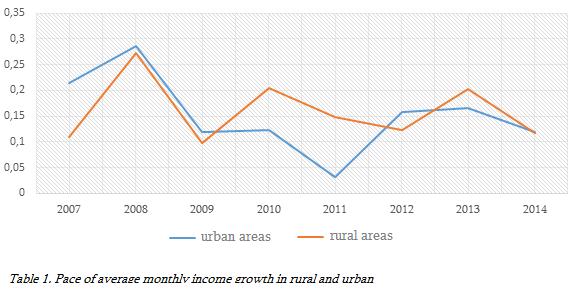

As seen on the diagram, (Table 1.), a visible high pace of income growth only occurred in 2007 in rural area. The period after 2012, is not actually more beneficial in terms of income in rural residents. Furthermore, with the approach proposed by the UNDP, growth in this component is more present in the period of 2010-2011 then afterwards.

It should be noted that among the components of Consumer Price Index (CPI), food products and non-alcoholic beverages (which have a bigger share of the basket of goods of the poor) were not characterized by higher increase in prices compared to other components.

Finally, I would like to summarize inclusive growth in relation to fiscal policy. Essentially, inclusive growth does not stray away dramatically from the logic of the “Washington Consensus”. In a similar fashion, inclusive growth puts emphasis on economic growth, which incorporates factors of production to the maximum extent possible and includes those who are situated on the left side of the income median.

Inclusive growth considers social policy, which encourages maximum engagement of factors of production and rejects “Kaldor-Hicks” logic (which states that economic growth is prevalent and then redistribution in the form of social welfare) expedient. While inclusive growth, as explained above, decreases future redistributive costs and ensures stability of the budget by ensuring engagement of the poor in the process of growth. However, it gradually leaves the impression of a relative approach to eradicating poverty (in other words, decreasing inequality by redistributive means, rather than by promoting productive employment), which does not represent the mainstream of inclusive growth.

Endnotes:

[1] The theory, according to which the inequality grows at the first stages of economic growth, while decreasing during the period of high level of income.

[2] C. Tilly. 2004. “Why Inequality is Bad for the Economy: Geese, Golden Eggs, and Traps.” Wealth Inequality Reader

[3] Deininger, K., and L. Squire (1998) “New ways of looking at old issues: inequality and growth,” Journal of Development Economics 57, pp. 259-287

[4] J. D. Ostry and others . 2014. “Redistribution, Inequality and Growth”. IMF

[5] Gini Coefficient measures the inequality of income. It varies from 0 to 1.

[6] The Inclusive Growth and Development Report 2015 published by the World Economic Forum.

[7] Using market or political power.

[8] Multi-component assessment, which include issues such as share of social security in GDP, government effectiveness in terms of providing social security, etc.

[9] T.Palanivel. 2011. „Consultation on Conceptualizing Inclusive Growth”, UNDP report.

The ideas expressed in the article belong to the author only and do not represent the position of IDFI, the University of Bremen or the Federal Foreign Office of Germany. Therefore, these organisations are not responsible for the content of the article.