Author: Besik Namchavadze (Economist)

The article was writen in the framework of the project "Strategic Plan Georgia 2020 - Strengthening Public Involvement" and was published on the blog "Georgia 2020".

Georgia pursues a free floating exchange rate policy. Therefore, fixing or changing the exchange rate of GEL is not the objective of the government’s economic policy. Yet, the macroeconomic and financial stability depends on the stability of the exchange rate of national currency. Since the level of dollarization is high (the share of imports in consumption of goods and services is 70%, 65% of loans are in USD, 75% of the state’s debt is in foreign currency), the fast depreciation of GEL is highly risky for the financial stability.

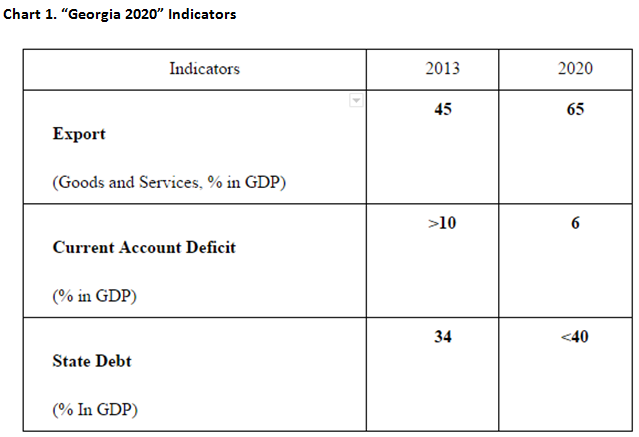

The stability of GEL will have a significant effect on the long-term economic development of the country. The Social-Economic Development Strategy “Georgia 2020” lists the share of exports of consumed goods and services in GDP, the current account deficit in terms of GDP, and the share of state debts in GDP as the main macroeconomic targets. The indicators of export and current account have significant effects on the exchange rate of the currency, while the stability of the state debts depends on the exchange rate.

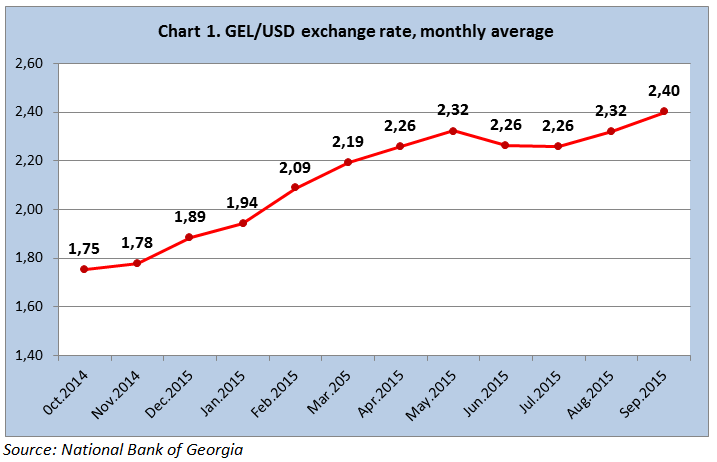

The national currency has started depreciating significantly since the end of last year. Reduced exports and increase in current account deficit precipitated the process. Over the last year, Georgian exports have dropped by 700 mln USD, while the remittances have reduced by 300 mln USD. The ensuing 1 billion USD deficit has not been compensated via other sources of USD inflows (tourism, investments, loans), hence GEL depreciated by 37%.

In 2013, the share of exports of goods and services was 45% of GDP, whereas in 2014, it reduced to 43%. The exports reduced by 24% during the first 8 months of this year, compared to the same period of the previous year. Hence, the exports will decrease in terms of GDP. All these factors make it harder to reach the objectives of “Georgia 2020”, to increase the exports to 65% of GDP, which is essential for high economic growth.

The current account deficit of 2013 was 6% of GDP and increased to 10% in 2014. Due to significant decrease in imports, this indicator is expected to decrease to 9%. Reducing the current account deficit is important for the stability of the exchange rate of GEL in future.

As already mentioned, 75% of the state debt is in foreign currency. Therefore, depreciation of GEL increases the burden of loan dramatically, which is translated into debt-to-GDP ratio. Over the last year, state debt in USD increased by 72 mln dollars. However, due to depreciation of GEL, state debt in GEL increased by 2.7 billion GEL. This number is complemented by domestic debt, which increased by 376 mln GEL in last year and overall debt reached to 42% of GDP. In the coming years, the government of Georgia will have to reduce its debt burden. This goal has to be achieved by decreasing the budget deficit and increasing the rate of economic growth.

According to strategy “Georgia 2020”, the objective of the monetary policy is to increase the economic “larization”, which includes increasing the share of loans and deposits in national currency in commercial banks. As of now, the dollarization coefficient of deposits and loans is 65%. With the depreciation of GEL, the trust in national currency is decreasing, which facilitates the process of dollarization. High level of dollarization is problematic, since, with the depreciation of national currency, the stability of financial sector comes under risk. If the debtors cannot pay off the loans in USD (since their income is in GEL), banks and other credit service organizations will be jeopardized. It's worth mentioning that the consumer (non-mortgage) loans (characterized by higher risks) in GEL are characterized by increasing tendency and reached 80% of the consumer loans by 2015, while the same indicator was 50% in 2010.

The principal factors affecting GEL are - inflow/outflow of foreign currency, changes in volume of national currency and expectations of public vis-à-vis the exchange rate of GEL. The above-mentioned factors are influenced by external (economic situation in our partner countries), as well as Georgia’s monetary (supply of money) and fiscal (budget and government spending) policies.

During the past 10 months, the main reason of the depreciation of GEL was the decrease in the inflow of foreign currency. As mentioned before, drop in exports and remittances by 1 bln USD was not compensated by other sources of income and the GEL depreciated. The reduction in exports and remittances still continues. In August, exports were reduced by 23.4% (58 mln USD) and remittances by 35% (59 mln USD). Imports decreased by 8.6% (59 mln USD) and reduced the negative effect of declining exports on the exchange rate.

Export-import balance and remittances do not show the whole picture of the inflow and outflow of currencies. It is important to have information about tourism and other sources of income from services, factor income, investment and credit capital to get a full picture of previous months (July-September). This information will be reflected in the capital account of the 3rd quarter, published by the end of December. As of now, we know the balance of payment of the first two quarters of 2015, which showed that the inflow of the foreign currency was 165 mln USD less than the outflow.

Reduction of Russian and Ukrainian economies, Greek crisis and the depreciation of the currencies in the neighboring states were the external factors having the greatest effect on the Georgian economy. External shocks were already reflected in the exchange rate of GEL. However, if the economic problems persist, these factors will have even greater effect. For instance, because of the Greek crisis, remittances of this year decreased by 50 mln USD and are expected to decrease by 100 mln USD by the end of the year.

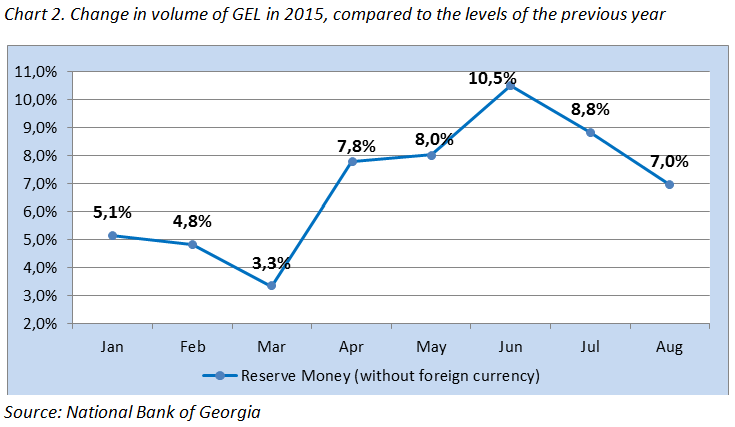

The decrease in the inflow of foreign currency will eventually be reflected in the decreased volumes of USD in Georgia. As the exchange rate of Lari is determined by Dollar-to-Lari ratio, the monetary policy can reduce the volume of GEL in circulation. In order to achieve this goal, tight monetary policy is necessary, which will ultimately lead to increase in the value of GEL. In such conditions, financial institutions will be prompted to borrow less in GEL from the National Bank (NB), whilst natural persons and juridical persons will also be inclined to borrow less in Lari.

The NB is responsible for the monetary policy, thus has the information about the volume of Lari in circulation. The direct denominator of the national currency emitted by the NB is the monetary base (reserve money), which increased by 7% (191 mln GEL) over the last year. Evidently, ensuring slow rate of increase of volume of Lari or maintaining it on a certain level is possible, however, the current pace corresponds to the rate of economic growth in the country.

If the NB tightened the monetary policy sufficiently, temporary stability of the exchange rate of Lari could be achieved, which would keep the volume of GEL in circulation at a fixed level. However, due to reduced demand on goods and services, the economy would have been in a recession. In addition, artificially sustained low exchange rate would negatively affect Georgia’s trade balance (due to reduced exports and increased imports) while eventually, the exchange rate would experience hurdles yet again. It should be noted that from February, the NB tightened the monetary policy significantly; refinancing rate increased by 3% and currently stands at 7%. Other things being equal, such tightening of monetary policy will lead to decrease in the volume of Lari in circulation in the medium-term perspective. Additionally, the NB sold 307 mln USD on the foreign exchange auction this year, thus in part, compensated for the shortage of Dollar.

Fiscal policy of the government had a negative effect on the exchange rate of the national currency as well. This was already visible in the last months of 2013 and 2014, when at the end of the last quarter Georgia had a sizable budget deficit. In times of deficit spending, the budget consumes more money than it can afford. The negative effects of budgetary expenses persisted throughout the year 2015 as well. The budget deficit in February, April, June and August was so overwhelming that it required financing from the central government deposits in the banks. That directly increases the volume of Lari in circulation, which contradicts the essence of tight monetary policy. We also have to consider that import dependency in Georgia is quite high and increased budget expenses promote more imports. This also contradicts one of the instruments of monetary policy, which implies decreasing imports by sustaining a high exchange rate.

Reducing budgetary expenses would be a step forward towards stabilizing the exchange rate of GEL, which was planned by the government. Administrative expenses were supposed to be reduced by 250 mln Lari, however, this was not achieved. Due to windfall revenues, the government decided to borrow by 100 mln Lari less domestic debt. To a certain extent, this will reduce the pressure of the budget deficit on the exchange rate of Lari. According to the 2016 preliminary budget, the government plans to increase domestic debt by 200 mln Lari, which is 300 mln less than the same indicator in 2015. Yet, in order to remove the budget’s pressure on the national currency, it's necessary in the last months of 2015 not to pursue high deficit spending, which occurred in the end of 2013 and 2014.

When the country pursues a free floating exchange rate policy, the currency itself becomes a crisis management tool. After the depreciation of currency, exports become cheaper and imports more expensive and this improves the trade balance. The demand for loans denominated in USD is decreased. Provided that the conditions (external and internal) do not deteriorate, the exchange rate will be stable.

Conclusion

The exchange rate of GEL completely holds on to the market mechanism and tightening of the monetary policy. There is no improvement in terms of the budget deficit and there was an insignificant growth in FDI in 2015. Instead of the promised 300 mln USD, privatization only produced a meager 60 mln USD. There are no attempts to take macroeconomic decisions to improve the business environment (reducing taxes and regulations). As a result, over the last year the national currency depreciated by 37%, whereas the rate of economic growth shrank to 2.8%. There is a deplorable economic situation in Georgia’s neighboring and partner countries as well. Considering these facts, attaining the macroeconomic goals set out in “Strategy 2020” becomes problematic. Thus, a revision of the strategy is necessary, focusing on high economic growth and inflows of foreign currency.

The ideas expressed in the article belong to the author only and do not represent the position of IDFI, the University of Bremen or the Federal Foreign Office of Germany. Therefore, these organisations are not responsible for the content of the article.