The significant decline in trade with Russia due to the Russian embargo initiated in 2006, followed by the war, had a devastating impact on the Georgian economy. However, it also served as a catalyst for the diversification of both exports and imports. The support of Western technical assistance played a crucial role in this process.

As a result, Georgia managed to establish new trade partnerships while strengthening ties with existing ones. This level of diversification would have been challenging to achieve under different circumstances. However, since 2013, there has been a noticeable increase in the share of trade with Russia, leading to a heightened economic dependence that complicates the diversification efforts.

While the introduction of bilateral economic sanctions will undoubtedly cause a short-term shock to the country, it is expected to drive the exploration of more predictable and lucrative markets in the medium term. Diversification is essential for tangible economic growth in the medium-term.

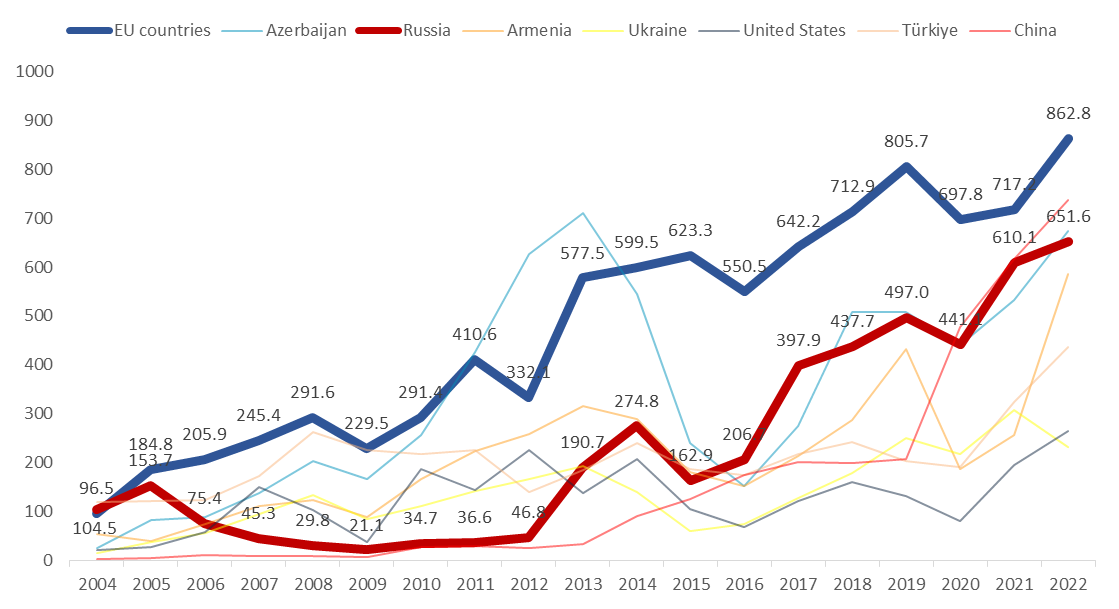

If Georgia succeeded in diversifying its exports before, there is no reason to believe it cannot do so again. Let's examine the experience of diversification in exports:

- From 2005 to 2011, the share of Russia in exports decreased significantly from 17.76% to 1.67% (a decline of $117 million, from $153.7 million to $36.6 million).

- Conversely, during the same period (2005-2011), exports increased with the following countries:

- Azerbaijan: from 9.64% to 19.48% (an increase of $342.5 million, from $83.4 million to $425.9 million).

- Armenia: from 4.59% to 10.19% (an increase of $183.1 million, from $39.7 million to $222.8 million).

- United States: from 3.09% to 6.56% (an increase of $116.8 million, from $26.7 million to $143.5 million).

- Ukraine: from 4.27% to 6.46% (an increase of $104.3 million, from $36.9 million to $141.2 million).

- However, starting from 2013, the share of Russia in exports experienced a significant rise, reaching 14.49% in 2017 (an increase of $351.1 million, from $46.8 million to $397.9 million).

Figure 1: Share of countries in Georgian exports, 2004-2022

Source: GeoStat, IDFI

Figure 2: Volume of Georgian exports, by country (millions of USD), 2004-2022

Source: GeoStat, IDFI

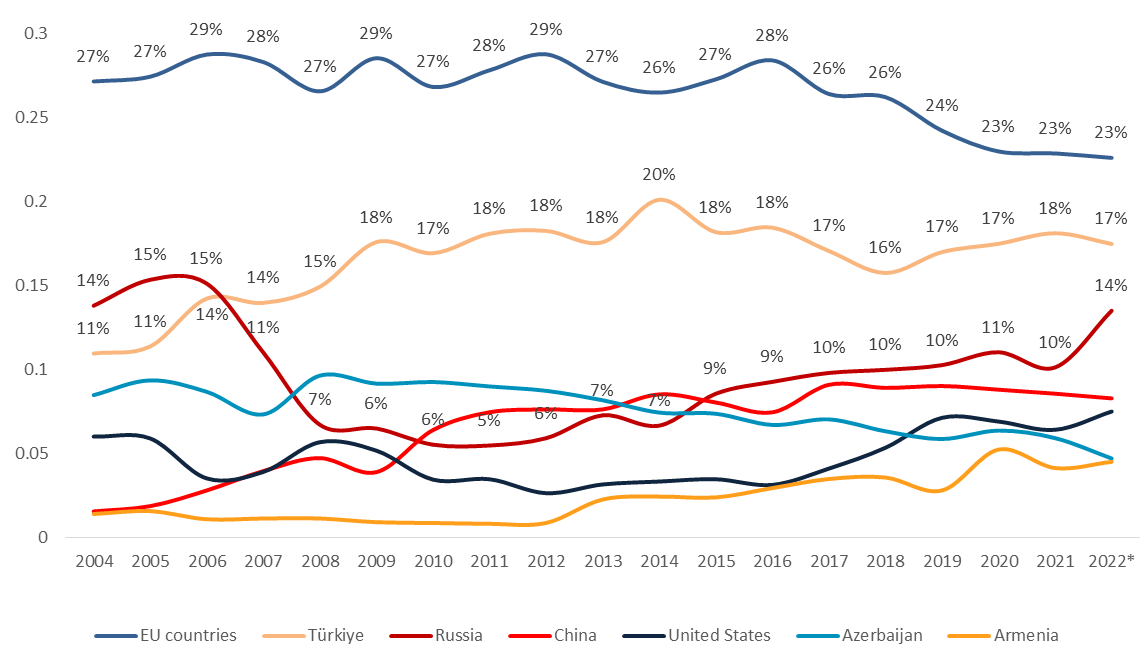

- Between 2006 and 2011, the Russian embargo and subsequent war had a significant impact on the share of Russian imports in Georgia, which declined from 15% to 5% (a decrease of $167.4 million, from $555.4 million to $388.0 million).

- Conversely, during the same period (2006-2011), the share of imports from other countries increased:

- The share of imports from Turkey increased from 14% to 18% (an increase of $756.1 million, from $522.6 million to $1,278.7 million).

- The share of imports from China increased from 3% to 7% (an increase of $424.4 million, from $103.3 million to $527.7 million).

- However, since 2012, the share of Russia as an important importing country has been on the rise once again. From 2012 to 2022, the share of Russian imports in Georgia grew from 6% to 14% (an increase of $1,358.7 million, from $476.9 million to $1,835.6 million).

- Recent data from January to April 2023 indicates that Russia continues to be the second-largest importing country, holding a 14% share ($622.3 million).

Figure 3: Share of countries in Georgian imports, 2004-2022

Source: GeoStat, IDFI

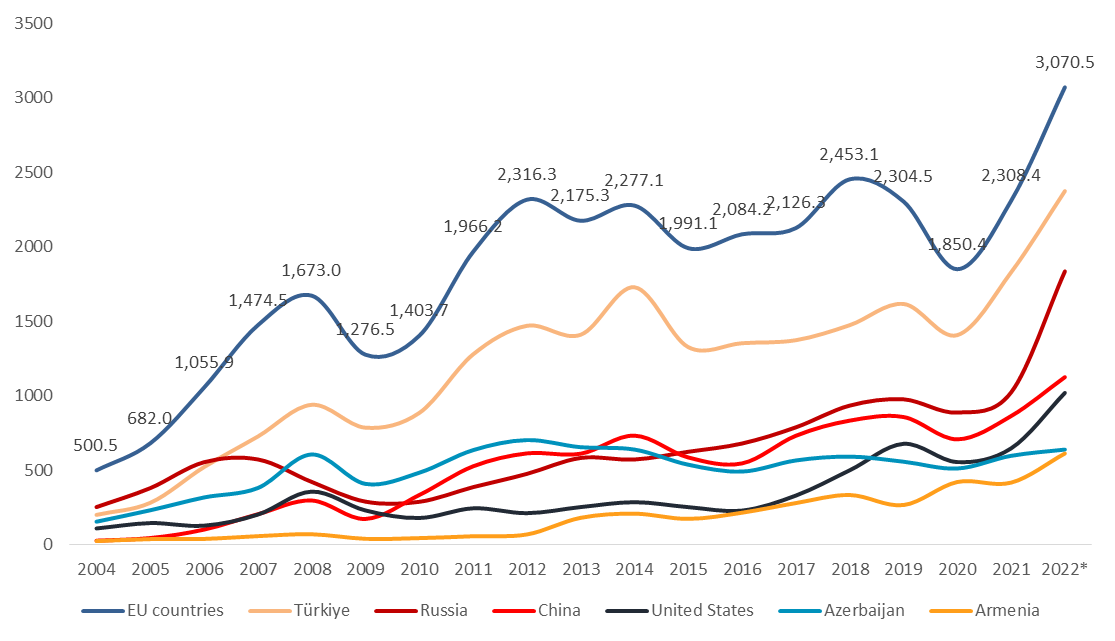

Figure 4: Volume of Georgian imports, by country (millions USD), 2004-2022

Source: GeoStat, IDFI

The increasing trade with Russia and the inflow of Russian capital, including spending and deposits by Russian citizens, may have short-term fiscal and monetary benefits. However, in the medium and long-term, this growing economic dependence on Russia carries significant risks that outweigh the short-term advantages. These risks can be categorized as follows:

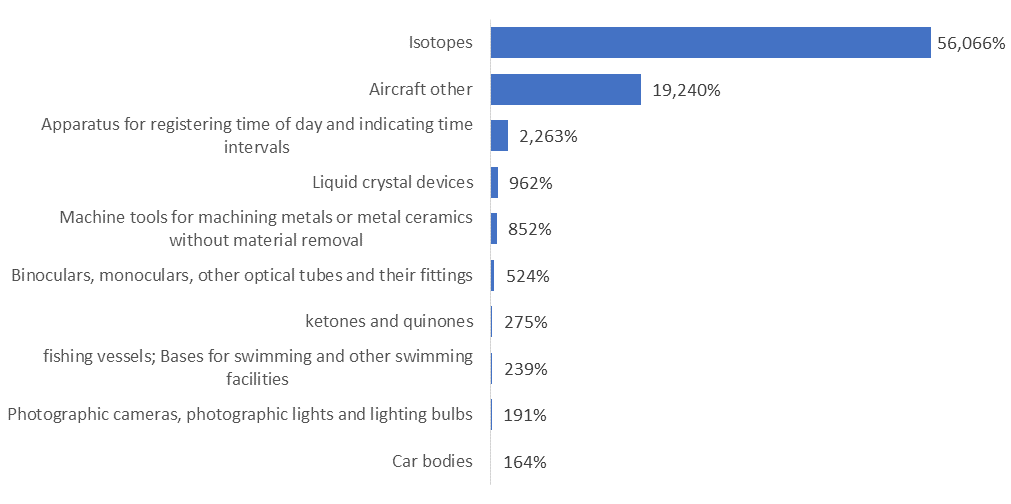

3.1. Eroding confidence among international partners: The doubts surrounding Georgia's role as a trade intermediary with Russia can undermine the confidence of international partners. The sharp increase in imports, particularly, raises concerns among our international partners. It becomes challenging to justify the substantial year-to-year increase in the country's demand for products. This lack of transparency can shake confidence in Georgia's economic practices.

Figure 5: Georgia’stotal import growth according to the 10 largest product positions, 2021-2022

Note:Aircraft comprises helicopters, planes, spacecraft (including satellites), telecommunication satellites, and others

Source: GeoStat, IDFI

3.1.1. Re-export: In 2022, there was a notable surge in re-exports to third countries. For instance:

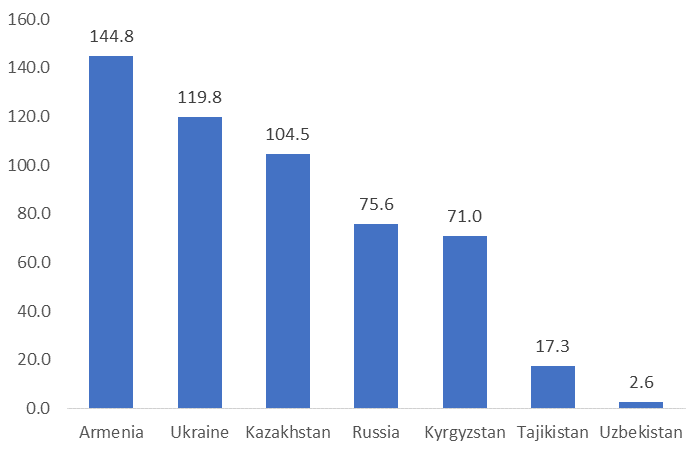

Figure 6: Re-export of light vehicles, 2022 (million USD)

Re-exports of light vehicles increased by 87% (imports rose from $935.4 million to $1,756.1 million), and it is possible that a portion of these vehicles finds its way to Russia.

Source: GeoStat, IDFI

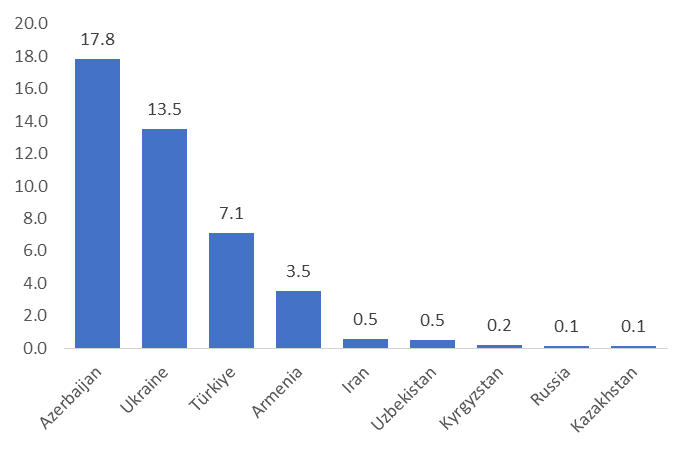

Figure 7:Re-export of oil and oil products, 2022 (million USD)

Re-exports of oil and oil products increased by 62.4% (imports grew from $823 million to $1,336 million), aiding Russia in selling oil at a time when it faces sanctions-related difficulties. Between 2019 and 2022, re-exports in this category increased by 23.3% ($171 million, from $732.8 million to $903.8 million).

Source: GeoStat, IDFI

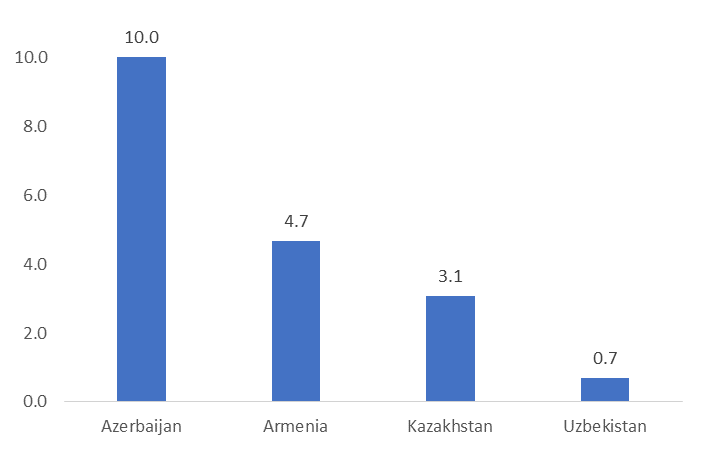

Figure 8: Re-export of phone devices, 2022 (million USD)

Re-exports of phone devices increased by 43.2% (imports rose from $225.9 million to $323.6 million). From 2019 to 2022, re-exports in this category rose by 18.2 times ($20.1 million, from $1.1 million to $21.2 million).

Source: GeoStat, IDFI

3.2.Inability to explore other profitable markets:Relying heavily on Russia impedes Georgia's ability to take advantage of other predictable and more profitable markets. The persistence of structural issues hinders the utilization of opportunities presented by free trade or preferential trade agreements with the European Union and other countries. When a country chooses one alternative, it inevitably forfeits the ability to pursue other opportunities. Economists refer to this as an opportunity cost.

3.3.Increased dependence on a market with limited demand:Russia's market stands out as one of the most politically motivated and, consequently, least predictable markets globally. Over the years, this has fostered complacency and lowered standards among many Georgian entrepreneurs, directly impacting the competitiveness of Georgian products in normal markets. The overreliance on the Russian market hampers the development of innovative and globally competitive industries.

Considering these implications, it becomes clear that the pursuit of further economic diversification is crucial for Georgia to mitigate risks, exploit profitable markets, and enhance the competitiveness of its products.