Author: George Loladze (Founder and the Director of the "Brokerage Company Caucasus Capital")

The article was writen in the framework of the project "Strategic Plan Georgia 2020 - Strengthening Public Involvement" and was published on the blog "Georgia 2020".

The article was writen in the framework of the project "Strategic Plan Georgia 2020 - Strengthening Public Involvement" and was published on the blog "Georgia 2020".

Besides direct investments, there are two major alternatives for financing of business and economy - bank loans and the securities market. The first mechanism implies the flow of investors’ money to banks in form of deposits (for certain interest) and its use by banks for issuing loans (with higher interest). In case of the securities market, money directly flows from investors to the economy - in exchange for securities issued by companies or other issuers.

When the best specialists of the field, with the assistance of US government, were designing foundations of the securities market in Georgia in 1998-2000, it was clear that the above two alternative, competing financing mechanisms should have been developed independently in the post-soviet state. In the countries with mature economies, these mechanisms are equally developed and hold commensurate shares in the market of financial services, as they had been developing simultaneously and had gone through comparable stages of development. Evidently, if two alternative mechanisms are in similar conditions (in other words at similar stages of development), natural competition takes place and even helps to increase their efficiency; However, if at the starting point one of them is at initial level of development, whereas the other has an apparent advantage (which was the case in Georgia due to historical or subjective reasons), natural competition between the two becomes impossible as the dominant mechanism will attempt to thwart any attempts of development of its competitor.

American experts were well aware of the situation and took it into consideration (despite the opposition from the commercial banks and the National Bank of Georgia) while drafting the Law on Securities Market, which was adopted in 1998 by the Parliament of Georgia (it was recognized as one of the best laws in the post-communist countries). According to the law, the securities industry was segregated from its natural competitor – the banking sector, to enable development of the securities market independently. This separation was reflected in number of aspects: banks could not participate in the market directly (only through subsidiary brokerage firms); none of a stock exchange shareholders could own more than 10% of its shares, while banks aggregate shareholding in stock exchange could not exceed 50%; securities market and its participants were regulated by the independent state regulator – the National Securities Commission of Georgia - which in addition to the regulatory functions was inclined to promote development of the securities market in the country.

Based on this legislation, in 1999-2000 the basic securities market infrastructure (the Georgian Stock Exchange, the Central Securities Depository of Georgia, 12 independent securities registrars) was established and became operational up to 40 brokerage companies were created and functional.

If such a foundation was created in 1998-2000, why is the securities market still not developed?

Securities market is a complex and multidimensional mechanism. Even the lack of a single piece of the mechanism is enough to provoke its failure. Therefore, there are numerous objective and subjective factors that influence normal functioning of the securities market (see Table 1. Securities Market Development Factors - Georgia). Currently, most of negative objective factors have been eliminated: for example, the macroeconomic situation is relatively stable, the share of shadow economy in the economy is minimal, crime rate has decreased, violation of property rights by organized crime or government bodies is practically eradicated.

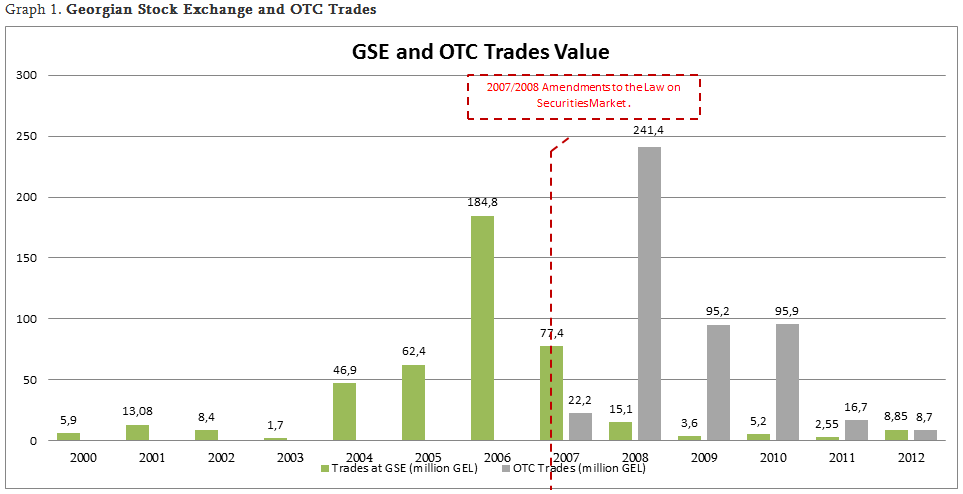

As for subjective factors, they often influence economic policy priorities and relevant reforms, and are reflected in legislation in the first place. Unfortunately, securities market was never a priority for either of the previous governments. Yet, as mentioned above, the Law on Securities Markets was formulated and adopted with the assistance of USAID and leading American experts. The law was a solid foundation for development of the securities market in Georgia and in fact, in 2000-2007 it started to gradually gain strength.

However, in 2007-2008 a powerful subjective factor came into play - policies of the United National Movement and the interests of one of the largest commercial banks closely related to the party (which was the first one to sense the danger to the status-quo, when there are no alternatives to commercial banks in Georgia’s financial sector). As mentioned above, none of the previous governments was interested in developing of the securities market in Georgia. Yet, United National Movement turned out to be the champion in this matter. The party was actively going against the basis of the existence of the securities market, such as corporate ownership diversification, developing of transparent and democratic mechanisms of corporate governance. In fact, it was much easier for them (UNM) to “control” small group of large owners and to control funding of all businesses in the country via two-three large banks. The previous government did not need a broad circle of private owners, since it would become the basis of middle class and an additional “head-ache”. This was exactly why selling the shares of leading Georgian companies on the local market was blocked. For instance, the head of the government often voiced the opinion to sell shares of Georgian Railway on Shanghai (!) or London stock exchange, and not in Georgia: like Georgian citizens were not worthy to become the shareholders of successful Georgian companies. Of course, these actions would have contributed to development of stock markets in China and UK, not in Georgia!

Moreover, by lobbying from the biggest banking group linked to the previous government’s two prime ministers, securities market legislation was distorted, which subsequently led to discretization and destruction of the Georgian securities market. More specifically:

All the factors mentioned above created mistrust toward the securities market among local and foreign investors. As a result, the market capitalization and securities turnover dropped significantly.

Additionally, also subjective factors are in roots of the following events hindering securities market development in the country:

Therefore, everything depends on the key political decision - whether priority will be given to some political groups and monopolistic aspirations of banks linked to them, or to the interests of country development. If one looks at the history of developed nations, the choice they have made is quite evident.

The question about readiness of the market and local investors to invest in the securities is frequently asked. What is necessary to develop the securities market and if there are problems in legislation?

As mentioned above, currently around GEL14 bn is at the bank deposits and significant part of the money would be directed toward alternative investment channels - in case they exist. Moreover, interest rates on deposits in foreign currency are significantly reduced compared to previous years. Therefore, potential demand for attractive financial instruments is quite high. What really matters is realization of this demand. So what is hindering the process?

As already mentioned, numerous factors determine functioning of the complex securities market mechanism. During various stages of existence of independent Georgia, number of factors hindered the operation of this mechanism (see Table 1). These factors affect demand and supply in the first place.

For instance, factors affecting the supply side are:

Whereas, factors influencing the demand side are as follows:

Generally, when attractive securities are artificially banned from or driven out of the market, there is a perception that indeed we have low demand on securities in general. However, certain historical examples show that as soon as such securities appear, we have an avalanche increase of the demand on them (2004-2007 dramatic increase of the demand on Bank of Georgia’s shares can serve as good example of this).

Finally, if the Government’s will to implement capital market reform is in place – what shall be done for achieving this goal?

In brief – the solution lies in solving all the above-mentioned problems. However, it’s better to highlight once again at least some steps essential for successful functioning of the securities market in Georgia:

1. Further improvement of the securities market infrastructure;

2. Supporting linking of this infrastructure into the international stock-exchange and clearing & settlement systems;

3. Institutional development of Georgian brokerage companies (investment firms, investment banks) – the major actors of the securities market.

*For details see:

http://for.ge/view.php?for_id=42754&cat=1

http://www.sazogadoeba.ge/news.php?post_id=35631

https://www.youtube.com/watch?v=STPgE_AYNdo

http://1tv.ge/ge/videos/view/151838/323.html

The ideas expressed in the article belong to the author only and do not represent the position of IDFI, the University of Bremen or the Federal Foreign Office of Germany. Therefore, these organisations are not responsible for the content of the article.