Author: Irakli Doghonadze (Economist)

The article was writen in the framework of the project "Strategic Plan Georgia 2020 - Strengthening Public Involvement" and was published on the blog "Georgia 2020"

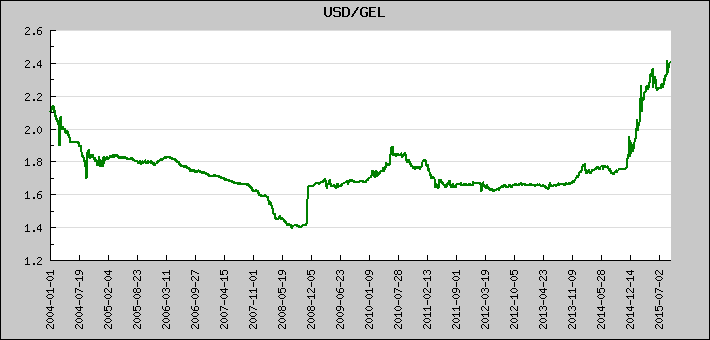

Since November 2014, the depreciation of national currency has caused problems for the society and for the state economy as a whole. A number of factors have had negative effects on the depreciation of Georgian Lari, and unfortunately some of them still continue the trend.

The exchange rate of the national currency against the USD is determined by the trade between Georgian commercial banks and local branches of foreign banks in Bloomberg’s electronic trade system. The weighted average exchange rate is determined according to the daily volume of each transaction and officially comes into effect the next day.

Georgia pursues a free floating exchange rate policy, which is characterized by fluctuations in the short-term. However, it also has a shock-absorbing function that stabilizes the system in the long run. In such conditions, the exchange rate of the national currency is determined based on the interaction of supply and demand.

Georgia pursues a free floating exchange rate policy, which is characterized by fluctuations in the short-term. However, it also has a shock-absorbing function that stabilizes the system in the long run. In such conditions, the exchange rate of the national currency is determined based on the interaction of supply and demand.

A number of factors has been affecting the demand and the supply of the USD on the currency market over the last period. It is important to note external, as well as internal factors of depreciation.

External factors include:

Internal factors include, on the one hand, the government’s fiscal policy, and especially the expenditure part of the state budget, and on the other hand, increasing dependence on internal loans in terms of budget revenues.

Exports decreased by 28% in November-December 2014, compared to the same months of the previous year. Whereas, the total exports of January-July, 2015 decreased by 24% with respect to the same period of the previous year.

With the decrease of exports in December 2014, we’ve witnessed 5% increase in imports, which led to further increase in trade deficit and had a negative impact on the exchange rate of GEL. There is a decrease by 11% in full indicator during January-July 2015, compared to the same period of the previous year. The above-mentioned further confirms the shock-absorbing qualities of the floating exchange rate system.

In addition to import-export, it is important to highlight other factors such as the issue of remittances. There is a 21% decrease in remittances in November - December 2014, compared to the indicator of the same period of the previous year, which is, for the most part, associated with the decrease of remittances from Russia. As for the indicator of January-July 2015, there is a decrease by 34% compared to the same period of the previous year, which negatively affected the exchange rate of GEL. This is due to the depreciation of the Russian Ruble. For example, if prior to the depreciation of the Russian currency, the savings of a Georgian immigrant in Russia was 10 thousand Rubles, which amounted to 250 USD, after depreciation, the same amount was only 150 USD. This, of course, explains the decrease in transfers in USD from Russia.

In general, the Current Account Deficit in the balance of payments of the country has worsened. In the fourth quarter of 2014, this indicator was 629 million USD, which is 44,6% more than the same indicator a year before. As for the first quarter of 2015, the deficit was 464 million USD, which is 26,2% more compared to the previous year.

The issue of repayment the foreign debt is no less important. According to the March 31, 2015 data, Georgia’s foreign debt amounted to 13, 434 mil. USD, out of which 30% was a government debt, 20% - bank loans, 21% - debt obligations toward investors, and 46% - the remaining sectors. Naturally, paying off this amount of loans, sooner or later requires corresponding amount of foreign currency. With the repayment of foreign debts, the demand for foreign currency increases. Its interesting to note that Georgia repaid more that 1.5 bil USD in third and fourth quarters of 2014. As for the current year, by March 31, 2015, the country had to immediately cover 1.4 bil. USD of debt and by the end of the year - 2.3 bil. USD gradually, which increased the demand on foreign currency.

It is also important to touch upon the issue of the budget. The budget revenues are of particular importance, where the increase of domestic debt is limited to 600 mln GEL. The given amount of loan pushes the interest rates up on the debt capital market. However, at the same time, the National Bank of Georgia actively employed all the monetary instruments at its disposal to preserve the stability of interest rates threatened by the monetary regime characterized by deflationary pressures and inflationary targeting, which in itself was caused by exogenous factors.

As for the risks associated with the depreciation of the national currency, the increase in service fees for credit and the deteriorating quality of bank’s portfolio is important to note, since 60% of the loans are in foreign currency. Additionally, anticipated risks are related to active inflation and the reduction of population’s net income, which further exacerbates their social-economic situation.

In conclusion, tight coordination and cooperation between fiscal and monetary governance is crucial. Encouraging foreign investments and tourism is also important, while improving legal environment for business and stimulating export at the legislative level will likewise contribute to the state’s economic growth.

The ideas expressed in the article belong to the author only and do not represent the position of IDFI, the University of Bremen or the Federal Foreign Office of Germany. Therefore, these organisations are not responsible for the content of the article.