Local governments are key actors in ensuring effective local service delivery and responsible for efficient public spending. To achieve this, municipalities establish non-entrepreneurial, non-commercial legal entities (NNLEs) and limited liability companies (LLCs) to delegate functions in various fields, such as supporting culture, sports, communal services, tourism, monument preservation, and early childhood development.

In recent years, several studies have focused on the operations of legal entities subordinated to municipalities, highlighting challenges within the bureaucratic system. For instance, reports from both IDFI and the State Audit Office of Georgia in 2021 revealed a steady increase in the number of employees in municipal NNLs and LLCs, leading to a rise in budget allocations for their remuneration. Additionally, the number and funding of NNLEs increased over time, elevating their role in local government activities.

Along with the increase in budget funds managed by legal entities, transparency in their operations has become crucial. Regrettably, the majority of municipalities struggle to ensure transparency, both in budget documentation and external communications, regarding the expenditures managed by legal entities. For example, only certain municipalities present the financial reports of their legal entities separately in budget execution reports. Furthermore, municipalities do not disclose public information about legal entities on their official websites. Consequently, the 2021 Local Self-Government Index reported that a significant issue was the lack of proactive disclosure of information about municipal legal entities.

An essential step towards enhancing transparency in municipal legal entities was the disclosure of information about these organizations on the electronic portal "Budget Monitor," established by the State Audit Office in 2017. However, consistent collection and publication of this information on the portal proved challenging, and after 2020, information about municipal legal entities was no longer published on the Budget Monitor Portal.

Given the limited proactive access to information about municipal legal entities, the process of requesting public information from local self-governments regarding these entities has become increasingly important. Nevertheless, within the scope of this research, it turned out that municipalities often fail to provide complete information about their legal entities, while some municipalities do not respond to the requests at all. For instance, out of the 64 municipalities surveyed by IDFI, only 38 municipalities provided a certain response.

Considering the partial responses from municipalities, together with unavailable public information, IDFI's research also focused on the expenditures arising from subsidies in the budgets of municipalities. As per current practice, a significant portion of subsidy costs from municipal budgets is allocated to legal entities. Analyzing these systematically placed data on the Ministry of Finance's website allows for an assessment of general trends regarding the funds received by these legal entities.

- On average, expenditures from municipal budgets under the subsidy article have been increasing by 26% each year. Consequently, in 2022, the total subsidy cost of 64 municipalities exceeded one billion GEL, reaching 1,049,202,528 GEL.

- In 2022, the subsidy expenditure from the Tbilisi Municipality budget amounted to 569.1 million GEL, which exceeded the expenditure of all other municipalities under the subsidy article by 89 million GEL.

- In 2022, compared to the previous year, Legal Entities Under Public Law (LEPL) established by Tbilisi Municipality received an additional 50 million GEL in financing, while NNLEs received an increase of 30 million GEL. Labor costs for employees in LEPLs increased by 20% (with additional 2.3 million GEL), and for NNLEs - by 23% (adding 8.1 million GEL).

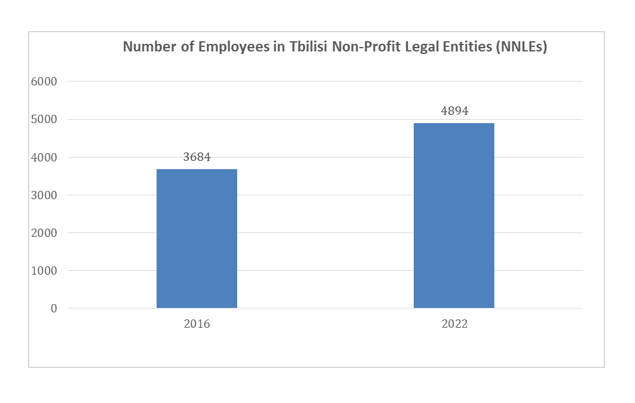

- In 2022, there were 4,894 employees (including part-time employees) in Tbilisi NNLEs, and the total remuneration amounted to 55.1 million GEL. Since 2016, the number of NNLEs in Tbilisi decreased from 79 to 71, but the number of employees increased from 3,684 to 4,894.

- Among Tbilisi NNELs in 2022, the highest median income was in "Tbilisi - World Book Capital", which amounted to 3,395 GEL, with 9 out of 11 employees working in managerial positions. Similarly, NNEL ”Tbilisi Development Fund” paid an average income of 2,990 GEL, and its executive director had 5 deputies and 4 advisers (*See the note below).

- Remuneration system in Tbilisi NNELs showed disparities. For instance, 58 employees of NNEL Public Communication Agency received approximately the same income as 143 employees of Tbilisi Zoological Park. Moreover, the 365 employees of the Municipal Services Development Agency were paid about 5 times more than the 353 employees of the National Youth Palace.

- In the last five years, the number of NNELs in Batumi decreased from 16 to 13. However, during the same period, their funding increased by 6 times, the number of employees grew by 9%, and labor costs increased by 89%.

- From 2019 to 2022, the financing of Rustavi NNLEs increased nearly twice from the budget (from 22.6 million to 40.6 million GEL), and the financing of LLCs increased approximately three times (from 1.8 million to 6.2 million GEL). As a result, the remuneration cost for NNLEs increased from 11.1 million to 18.6 million GEL, and for LLCs, it increased from 667.5 thousand to 3.6 million GEL.

- In 2022, there were 447 non-entrepreneurial (non-commercial) legal entities under 38 municipalities. Among them, Tbilisi had the most (71 NNELs), while Khobi municipality had the least (4 NNELs).

- In 2022, five municipalities established seven new NNELs, employing 401 individuals and spending 2.9 million GEL on remuneration. Notably, 281 employees were hired in the two new NNELs of Kvareli Municipality.

- According to information received from 34 municipalities, a total of 33,549 individuals were employed in municipal NNELs in 2022. Compared to the previous year, the number of employees in those legal entities increased by 5%.

- In some municipalities, the percentage share of the population employed in NNLEs exceeds 10%. For instance, 15% of the Tsageri population, 13% of Kazbegi population and 10% of Lentekhi Municipality population are employed in NNELs.

- In 2022, the total remuneration expenses (including part-time employees) of NNELs in 31 municipalities reached 221.5 million GEL. Compared to the previous year, the labor cost increased by 28%.

- In 2022, the salary increments for NNELs varied between 6% to 89% across different municipalities. The most significant increases were revealed in Kvareli (+89%), Dmanisi (+47%), and Chkhorotsku (+45%).

- In 2022 (based on 13 municipalities), the number of employees in LLCs increased by 6%, and labor costs rose by 16%.

- Out of 64 municipalities, only 38 provided public information about NNELs, and merely 20 municipalities answered regarding LLCs.

Based on an analysis of municipal budget documents and information received through the requests, it is evident that the funding of legal entities established by municipalities continues to grow steadily. Consequently, the bureaucracy of municipal NNELs and LLCs expands each year, leading to an increase in the budget funds allocated for employee compensation.

The circumstances uncovered while studying the bureaucratic structure of municipal legal entities also raise concerns about the potential mobilization of administrative resources. For instance, in some municipalities, the number of employees in NNELs exceeds 10% of the total population, and the growth of bureaucracy persists despite a decrease in the number of legal entities.

The analysis of labor costs within legal entities reveals a lack of unified remuneration policies across different municipalities, resulting in significantly different remuneration amounts for the similar/same job positions. Consequently, despite rising labor costs, a fair compensation system remains challenging.

Despite the expanding scope of activities carried out by municipal legal entities, their financial transparency shows backsliding. The number of municipalities providing comprehensive public information is decreasing, and partial, factually inaccurate, and inconsistently recorded data on the financing of legal entities in budget documentation hinders thorough analysis.

Considering the research findings and the State Audit Office's reports on human resource management in NNLEs, IDFI emphasizes the importance of municipalities reviewing their existing personnel and remuneration policies within the legal entities. Effective measures should be taken to ensure flexibility and optimization in the formation of the bureaucracy.

*(Note) As per documentation published on the website of the National Agency of Public Registry, one week before the study's publication (20.07.2023), NNLE Tbilisi - World Book Capital was canceled.