- 45,349 Russian citizens opened new accounts in commercial banks of Georgia from the beginning of the Russia-Ukraine war to August 31st.

- The number of Russian citizens with active accounts in commercial banks exceeded 60,000 as of August 31st.

- 19 legal entities registered in Russia opened their own accounts in the commercial banks of Georgia between February 24 and August 31, 2022.

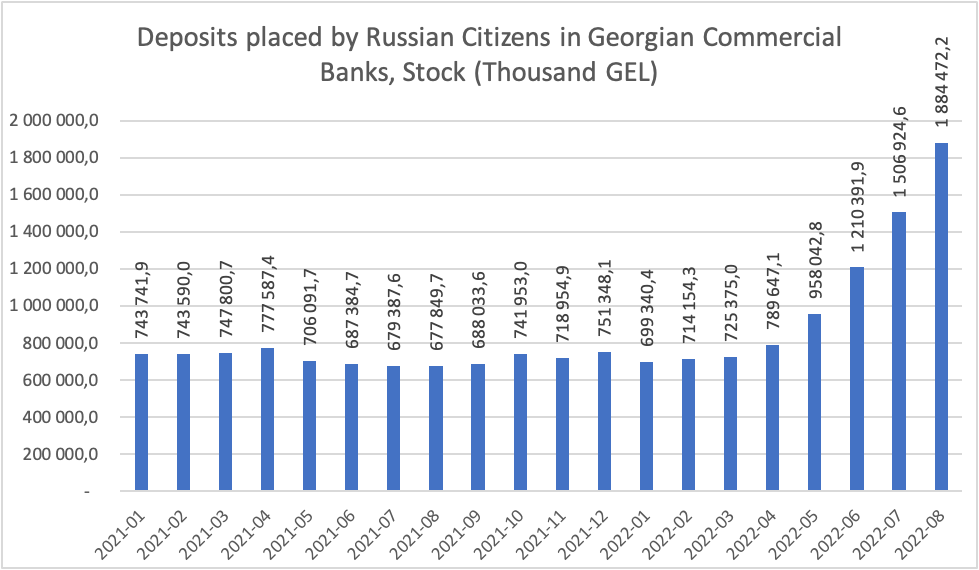

- Russian citizens' deposits in Georgian commercial banks amounted to 1.88 billion GEL as of August 2022.

- Deposit stocks placed by Russian citizens in commercial banks of Georgia increased by approximately 1.2 billion GEL (+170%) compared to the pre-war period (before February 24, 2022);

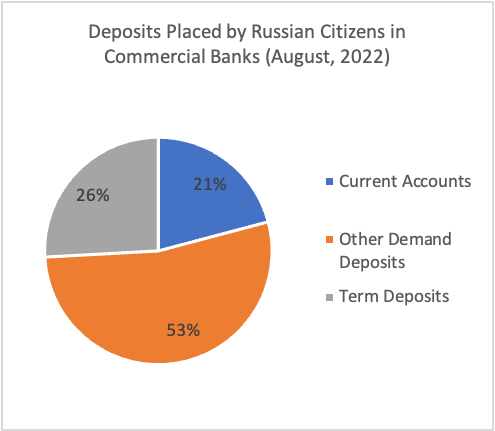

- Only 26% of deposits placed by Russian citizens are term deposits, which reached 60% in the pre-war period, as of August 2022.

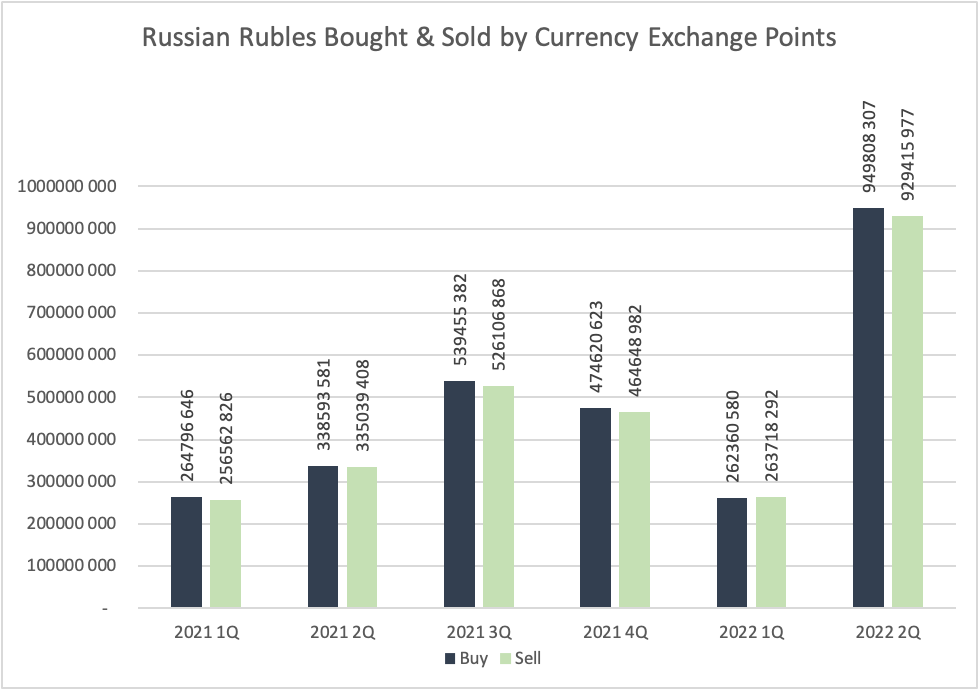

- Currency exchange offices bought 949.8 million rubles and sold 929.4 million rubles in the second quarter of 2022, which is about three times more than in the same period in 2021.

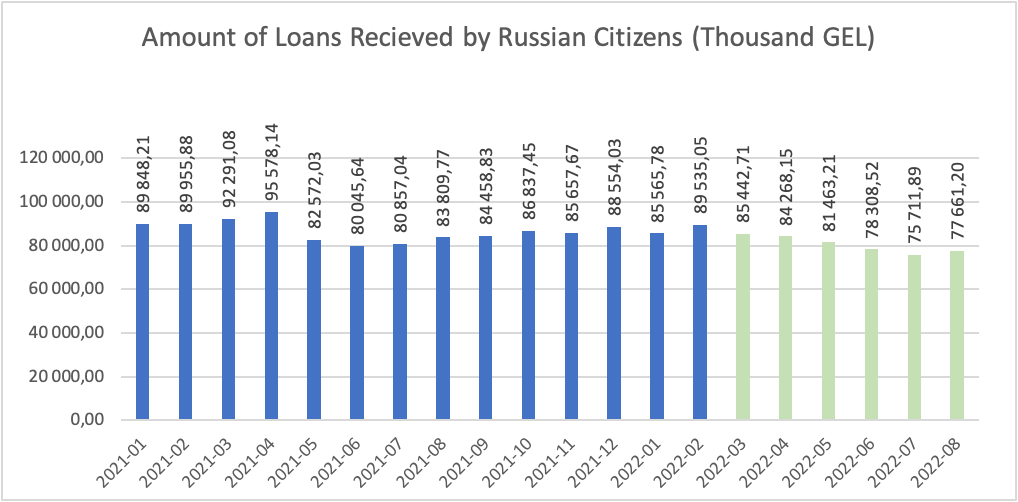

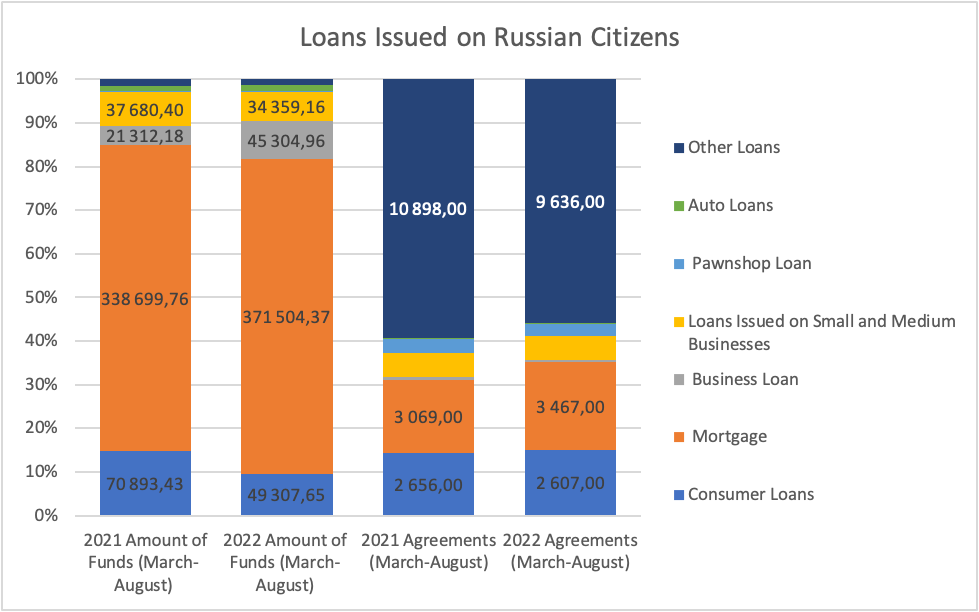

- In the period of March-August 2022, loans amounting to 482.8 million GEL were issued to Russian citizens, which is approximately 6% lower than the figure for the same period from the previous year. Despite the decrease in the number of loans, 1,118 more loan agreements were signed.

After Russia's invasion in Ukraine, one of the most important challenges for Georgia has been the influx of Russian citizens into the country. IDFI periodically studies and publishes various statistical data related to the border crossing and granting of Russian citizenship in Georgia. This time, IDFI will present an analysis of the data requested and received from the National Bank of Georgia related to the various activities carried out by Russian citizens in the financial organizations of Georgia following the war. In particular, this article presents an analysis of the statistical indicators of Russian citizens opening bank accounts in Georgia in 2021-2022, placing money in bank deposits, taking loans, and exchange of Russian rubles at currency exchange points.

While analyzing the data of Russian citizens crossing the border of Georgia, IDFI made an assumption that the visit of more than 42 thousand Russian citizens who entered the country in the period of March-June was related to tourist purposes to a lesser degree, as they did not leave the country even after 1 month (as of July 30). The data on opening accounts in Georgian commercial banks, which is consistent with the probable cases of migration of Russian citizens to Georgia, gives a clearer picture.

- According to the information provided by the National Bank of Georgia, 45,349 citizens of Russia opened new accounts in commercial banks of Georgia from the beginning of the Russia-Ukraine war until August 31.

- The number of accounts opened monthly varied between 6,000 and 10,000.

- According to risk supervision AML reporting forms, 28,221 Russian residents had active accounts in the entire banking sector as of December 31, 2021. This figure increased to 58,162 as of June 30, 2022.

- Taking into account the fact that in the following two months 13,375 Russian citizens opened new accounts, we can assume that the number of Russian citizens with active accounts exceeded 60,000 as of August 31.

The information provided by the National Bank of Georgia also includes data about legal entities, and according to this data, 19 legal entities registered in Russia opened their accounts in commercial banks of Georgia between February 24 and August 31.

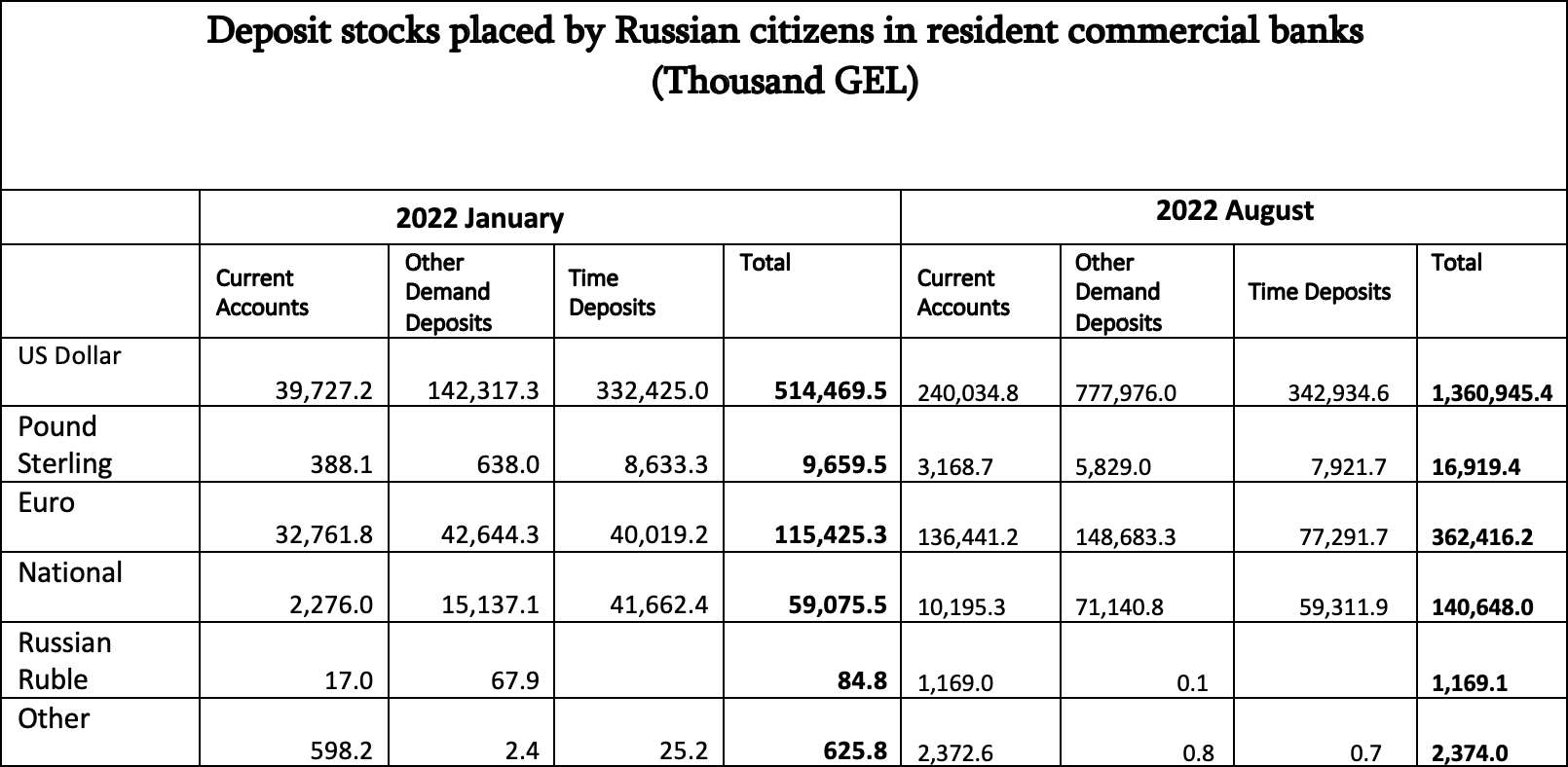

The number of deposits opened by Russian citizens in commercial banks of Georgia significantly increased after the start of the Russia-Ukraine war, as a result of the active entry of Russian citizens into Georgia. In particular, deposits placed by Russian citizens in commercial banks of Georgia amount to 1.88 billion GEL as of August 2022, which is 1.18 billion GEL higher than the figure before the war (January 2022), and 1.2 billion GEL higher than the same month (August) of the previous year. Thus, the deposit stocks placed by Russian citizens in commercial banks of Georgia increased by 170% compared to the pre-war period.

As of August 2022, 53% of the deposits held by Russian citizens are demand deposits, 21% are current accounts, and 26% are term deposits. The share of term deposits reached 60% before the war.

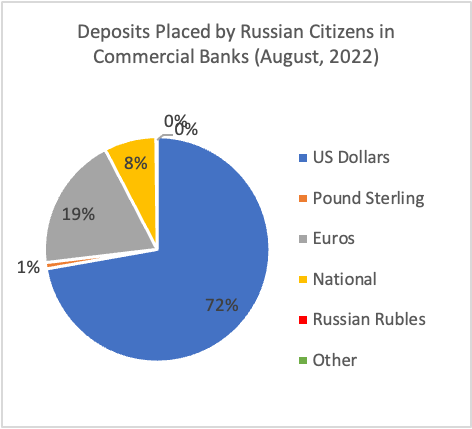

72% (1.36 billion) of deposits placed by Russian citizens in commercial banks worth 1.88 billion GEL are placed in US dollars, while only 0.06% (1.2 million) are placed in Russian rubles.

After the start of the Russia-Ukraine war, the active influx of Russian citizens into the country did not have a significant impact on the volume of loans received by Russian citizens in financial organizations of Georgia. For example, in the period of March-August 2022, loans in the amount of 482.8 million GEL were issued to Russian citizens, which is about 6% lower than the figure for the same period in the previous year.

It should be noted that, despite the decrease in the total amount of loans, in the period of March-August 2022, 1,118 more loan agreements were signed with Russian citizens as compared to the same period in the previous year.

The National Bank of Georgia did not have information on the number of unique individuals receiving loans.

According to the quarterly data presented by the National Bank of Georgia, after the start of the Russia-Ukraine war, the turnover rates of the Russian ruble at the currency exchange points in Georgia have increased significantly. Specifically, in the second quarter of 2022, the currency exchange offices have purchased 949.8 million rubles (about 45 million rubles or 16 million USD equivalent at today's exchange rate) and sold 929.4 million rubles, which is about three times more than in the same period of 2021.

The inflow of Russian rubles through Russian citizens, active trade in Russian rubles boosted by the expected consequences of sanctions on Russia, and others can be considered as the determining factors in the significant increase in the turnover of Russian rubles at the currency exchange points in Georgia after Russia's invasion of Ukraine.

The analysis of the data received from the National Bank of Georgia shows that, after the start of the Russian-Ukrainian war, the influx of Russian citizens into Georgia significantly contributed to the growth of the funds of Russian citizens in the commercial banks of Georgia. For example, new bank accounts were opened by 45,349 citizens of Russia, the deposit stocks increased by 170%, while the turnover rates of the Russian ruble tripled. In addition, according to publicly available data on the website of the National Bank of Georgia, the indicators of money transfers from the Russian Federation to Georgia have increased significantly. Accordingly, the analysis of the data shows that the circumstances created as a result of Russia's invasion of Ukraine contributed to the inflow of significant financial resources from Russia to Georgia, which in turn had an impact on various economic indicators of the country in the short term, including economic growth, stabilization of the exchange rate, etc.

IDFI believes that, despite some positive economic effects achieved by the influx of Russian citizens into the country in the short term, their growing tendency of staying in the country for a long-term period may present a challenge for state security and requires appropriate measures to reduce potential risks.

___

The analysis was prepared by the Institute for Development of Freedom of Information (IDFI). It was supported by a grant from Luminate. IDFI is responsible for the content of this document. Views expressed in therein do not reflect the position of Luminate.

%MCEPASTEBIN%