IDFI launched the periodic review of Georgia’s economy in 2021. The current review covers the state of GDP, external trade, remittances, FDI, exchange rate, budget, and external debt as of the first 9 months of 2021, as well as projections for the coming year.

Periodic economic review will allow the identification of challenges and help increase access to information. Identifying existing opportunities will enable stakeholders to concentrate on developing economic policies and increase the effectiveness of public policies meant to support the population and businesses in overcoming existing economic challenges.

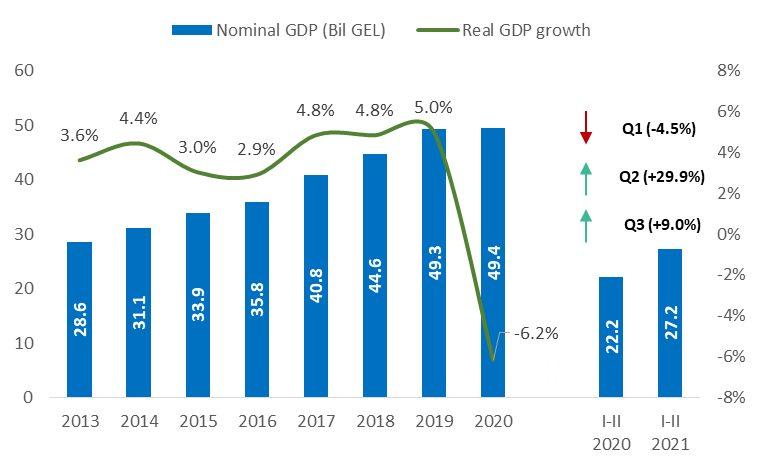

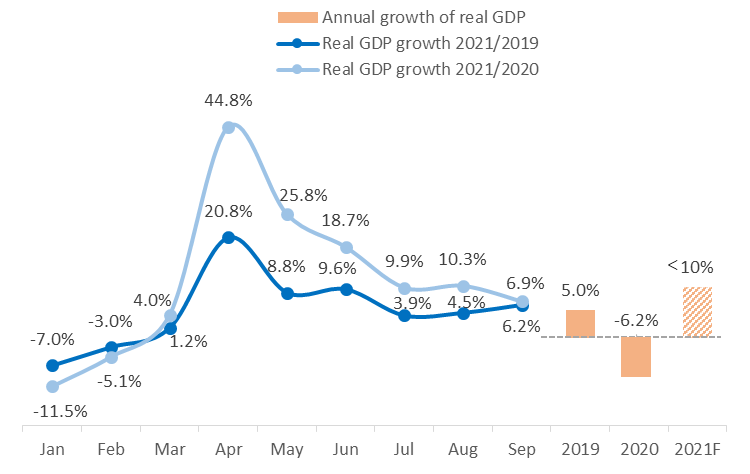

- The Georgian economy is expected to surpass the 2019 level in 2021. The economy began to recover in Q2 2021, with the real GDP increasing by 11.3% in 9m 2021. The growth, however, is expected to slow down, and the economy is expected to surpass the 2020 level by around 10% in 2021.

- The restrictions imposed by the government in Georgia due to the COVID-19 pandemic were one of the most severe as compared to other countries, but ineffective and failed to prevent the high incidence of COVID-19 infections. At the same time, it has led to a significant decline in the economy. In 2021, the highest stringency index was in January, followed by a decline in real GDP of -11.5% in the same period.

- GDP per capita in Georgia (USD 4,270 in 2020) is 8x lower compared to the EU average, 2x lower than that of Russia and Turkey, and almost equal to Armenia, Azerbaijan, and Ukraine.

- Unemployment rate increased to 22% in 1H 2021, +3.7 p.p. up, compared to the same period in 2020. Additionally, the labor force decreased by 2% to around 1.5 mln in 1H 2021. Additionally, 64% of the employed population had a monthly salary of less than GEL 1,200, andonly 13% of employees had a monthly salary above GEL 2,400 in 2020.

- Economic growth has less impact on the population. The purchasing power of the average wage in 2020 has increased by only 11% in the six-year period. However, the nominal wage has increased by 46% in the same period. Cumulative economic growth was approx. 16% during that period.

- The trade deficit widened by USD 0.6 bln in 9m 2021, compared to 2020. Export rate, however, is growing faster (+24% YoY) compared to imports (+22% YoY) in the same period.

- The share of exports to the EU has been following a descending trend since 2015. However, the shares of exports to Russia and China have been increasing since 2015 and 2019, respectively. The rate of diversification of Georgia's export market has not changed significantly in recent years, but higher dependence on Russia poses a threat that exporters may face difficulties under a possible embargo.

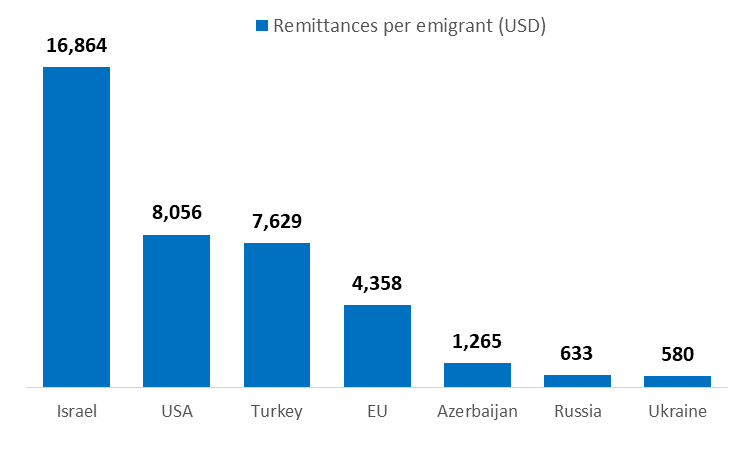

- Remittances per emigrant[1] from Russia (USD 633) are 13x lower than from the USA and 7x lower than from the EU. Israel leads in the volume of remittances per emigrant (USD 16,864). Indicator is also high from the US and the EU countries, comprising USD 8,056 and USD 4,358, on average, respectively.

- FDI decreased sharply and the Business Confidence Index has deteriorated significantly in 2021. FDI decreased by -11% and amounted to $366 mln in1H 2021, which is almost a half of the FDI in the pre-pandemic period.

- Government debt is at a record high. In 2020-2021, the ratio of public debt to GDP increased dramatically and reached 62% as of the 8m of 2021. Debt to GDP ratio is recommended not to exceed 40% for developing countries and 60% for developed countries.

- The dollarization of household and business loans decreased to 35% and 67%, in September 2021, respectively, accompanied by the GEL appreciation against the US dollar. The de-dollarization of household loans goes faster than business loans on the basis of the imposed regulations.

Economic closure is not the only solution, and it is important to accelerate the process of vaccination in the country to avoid a recession. With the shutting down ofan economy, the dependenceof the population on social assistance is higher.The increasing public debt (which has exceeded 60% of GDP) limits the government’scapacity to provide social assistance, leading to the significant deterioration of the economic conditions in the population. Awareness-raising campaigns in the population regarding the necessityof rapid vaccination and targeted restrictions should be highly prioritized.

The average annual stringency index in Georgia is higher compared to the world average. However, this did not prevent the spread of the infection. The infection rate in Georgia is much higher than inother countries with a similar average stringency index.

The ratio of public debt to GDP increased dramatically and exceededthe 60% thresholdin 2020-2021. It should be taken into consideration that in the case of exchange rate depreciation, this ratio may increase further, which will increase budget expenditures and lead to a higher risk of insolvency.

Thecurrent state of Georgian economy does not allow an adequate response to the existing socio-economic challenges in the country. Universal social packages are ineffective for the purposes of alleviating poverty, and the government should be focused on allocating liberated resources to targeted social groups and overcoming poverty.

The unemployment rate increased to 22% in 1H 2021, +3.7 p.p. up compared to the same period in 2020. Additionally, the labor force decreased by 2% to around 1.5 mln in 1H 2021. Additionally, 64% of the employed population had a monthly salary of less than GEL 1,200, and only 13% of employees had a monthly salary above GEL 2,400 in 2020.

Unstable political environment, legal disputes with investors, delays in the implementation of important international infrastructural projects (e.g. suspension of the construction of a deep sea port), lack of qualified human capital, and labor outflow from the country makesGeorgia less attractive to investors. It is necessary to improve the investment environment in the country and to encourage the inflow of investments. It is especially important to encourage privatization of state-owned enterprises that operate at a loss.

FDI decreased sharply and the Business Confidence Index has deteriorated significantly in 2021. FDI decreased by -11% and amounted to $366 mln in 1H 2021, which is almost a half of the FDI of the pre-pandemic period.

State-owned enterprises are mostly operating at loss, and the existing debt burden on these enterprises is a significant fiscal risk to the budget. This is a lost opportunity for privatization and hinders the development of these sectors. Moreover, financial pressures do not allow the government to issue additional guarantees to investors (e.g., guaranteed purchase agreements for the energy sector, which are necessary for the development of renewable energy capacities).

It is desirable to promote the diversification of export markets and increase the quality of exported goods in order to reduce dependency on low-purchasing power and high-risk countries (e.g. Russia) and allow exporters to explore high-purchasing power markets.

Despite the free trade regime with the EU, the share and volume of exports to the EU have been declining since 2015. However, the shares of exports to Russia and China have been increasing from 2015 and 2019, respectively. Overall, the rate of diversification of Georgia's export market has not changed significantly in recent years. However, higher dependence on Russia poses a threat that exporters may face difficulties under a possible embargo.

The government of Georgia needs to develop a long-term economic policy, which would aim to develop human capital and improve skills in strategic areas (information technology, vocational education, etc.).

It is important for the country to develop long-term economic policies and a corresponding implementation plan thatwould clearly define the priority directions for the country and set a target for a minimum rate of economic growth each year.

___

[1] The calculation is based on the data of migration in 2017 and data of remittances in 2020.

This material has been financed by the Swedish International Development Cooperation Agency, Sida. Responsibility for the content rests entirely with the creator. Sida does not necessarily share the expressed views and interpretations.