Pension reform in Georgia began in 2018. Finding instances of effective pension reform in emerging economies, even those with extensive experience in implementing such reforms proves to be challenging. The top ten countries for retirement[1] are, for the most part, the richest countries on the planet [2], and Georgia falls far behind these. In these countries, comfortable retirement standard is based on the sustainability of their pension systems. The sustainability is in turn determined by the wealth of these countries.

The country is not wealthy enough to allow the initiated pension reform to fail… Namely, economically developed countries can make up for the mismanagement of pension assets with taxpayers' money, but not Georgia.

The following report analyzes:

- The main challenges in pension asset management and reform as a whole, namely, the riskiness of investing now and in the future, the independence of asset management, etc.;

- International experience;

- recommendations.

The four main challenges facing the pension reform are:

The Pension Agency is tasked with maximizing pension savings through sound portfolio management (primarily to protect savings from inflation), rather than of the capital market development.. The latter can be considered as a side effect of the pension reform, just as, for example, economic growth is for the National Bank of Georgia. The development of the local capital market and the management of pension savings oriented towards maximum growth can constitute competing aims, that is, one can interfere with the other, just as halting inflation can inhibit economic growth.

2.1. Inflation: The riskier the pension investment, the higher the return. As this risk increases, so do the risks of losing retirement savings. However, with low-risk investments, pension fund managers are unable to keep pace with inflation, which is compounded by the pandemic and war-induced inflation.

Thus, pension fund managers face dilemma between choosing low-risk and high-risk retirement savings investments. From the establishment of the Pension Agency until August 2023, pension assets can only be invested in a less risky investment portfolio, although within this limitation it is still possible to make relatively riskier investments. In August 2023 the five-year restriction period expires . The restriction requires that pension assets be invested only in a less risky investment portfolio.

The future of Georgia's pension funding depends on how the Pension Agency manages the major tradeoff between risk and growth that the pension funds of many countries are facing. It should also be considered that in wealthy countries there is a tangible fiscal resource backing the pension funds, but in Georgia, it is so scarce that it is impossible to compensate the pension savings with taxpayers’ money. This is why the cost of mistakes by pension asset managers in poor countries is much higher than in rich countries.

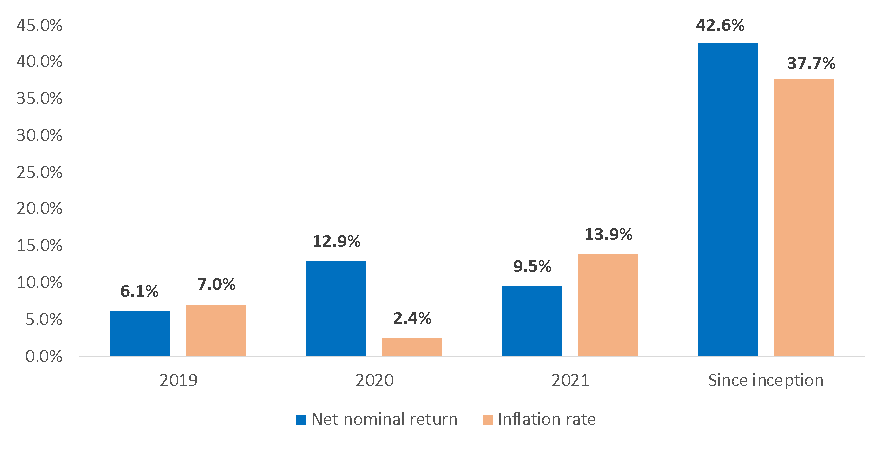

Since the start of the reform , the actual growth of Pension Agency assets has been 3.56% (annualized 0.84%)[4], which would have been higher if the portfolio consisted of assets with higher risks, meaning higher premiums. This is prohibited by the law until August 2023. (see figure below).[5]

Figure 1: Net Nominal Fund Revenue and Inflation[6]

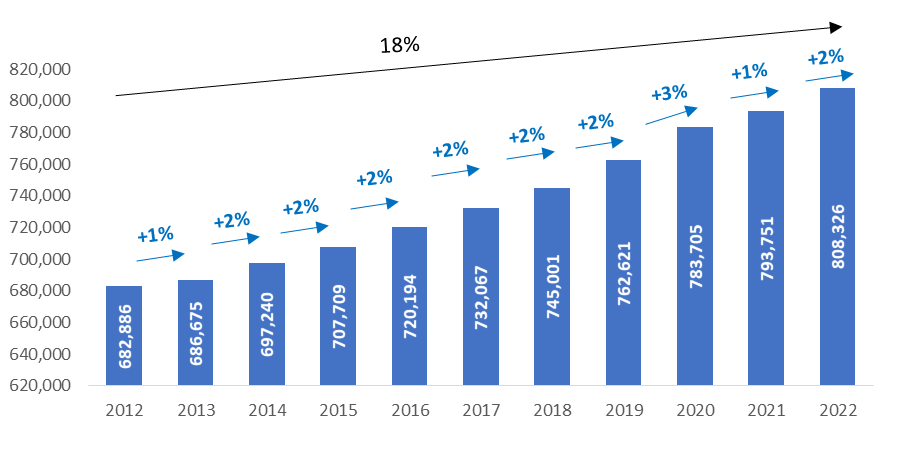

In 2012-2022, the number of retirees in Georgia increased by 18% (125.4 thousand people), while the country's population decreased by 50.7 thousand people during the same period, which is a 1% decrease in the population.

According to the explanatory card of the funded pension law, by 2030 the total number of pension and social assistance recipients will reach 1.1 million. By 2060, the expenses on pensioners will be about 30% of budget revenues, if current 18% replacement rate[7] is maintained. These expectations raise concerns regarding the sustainability of the social pension system.

It should be noted that a rising number of countries are realizing that the increase in the number of retirees burdens the economy and hinders its development. For example, in October 2021 in the USA, according to the St. Louis Federal Reserve Board, there were 3.3 million more retirees in the country than 20 months earlier. According to the Pew Research Center (think tank based in Washington), more than half of Americans over the age of 55 have left the workforce, up from 48% in the third quarter of 2019.

In several countries, along with the growing number of retires:

- The retirement age was raised. For example, in the Netherlands, between 2013 and 2022, the retirement age has slowly increased from 65 to 67 years. Moreover, due to the increase in life expectancy, the retirement age is planned to increase even more[8]; in Denmark in 2019-22, it was raised from 65 to 67[9]years; In France, from 62 to 64 years, although the efforts to raise the retirement age have sparked widespread national opposition and paralyzing strikes.[10]

- The move towards increasing the retirement age began in earnest, for example, in Germany, Sweden, Belgium, Japan, Spain[11].

- Changes to pension rules to encourage retirees to return to work are actively being considered, e.g. in the UK, Ireland. In the UK, the current state pension age (66 years for both men and women) will rise to 67 in 2028 and 68 years in 2046. For those born after April 6, 1978, the state retirement age limit will be 68 years.

Figure 2: Number of Persons Receiving Pensions in Georgia, 2012-2022. [13]

Between 2012 and 2022, the number of retiree pension recipients in Georgia increased by 125,440 (18.3%), and pension as a share of budget expenditures increased from 16% to 19% (1.817 billion GEL) and will reach 21% of expenditures in 2023.

Figure 3: Pension Provision of the Population (Millions GEL) and the Share of Pension in Budget Expenditures (%), 2012-2023.[14]

- The social (basic) pension will continue to grow, which will hinder economic growth: The rationale behind the funded pension system is that when state pension recipients also become beneficiaries of the funded pension system, the state pension should either stay the same or grow at a a slower pace compared with what would have occurred without the pension reform. The constant increase of social (basic) pension along with the increase of tax revenues hinders both economic growth and development.

- The increase in social (basic) pension costs will be a burden on the taxpayer. Under the conditions of the alternative, i.e. funded pension system, costs should increase at a lower rate than without it and, accordingly, the burden should be lightened.

- Individuals remain without adequate financial security in the face of old age, especially when the incomes do not allow them to save, and those who have the means are not culturally geared to saving.

- People remain dependent on the state, i.e. taxpayers, when they could depend on their own funds saved during their productive years.

According to the capital market development strategy of Georgia for 2023-2028, in 2025, the total value of pension fund assets is planned to increase 6.55 billion GEL, 3.25 times the value from 2021. In 2028, it will reach 12.1 billion GEL, which means an increase of 6.02 times the value from 2021. Growth at such a rate requires investing in assets with a higher risk than the existing ones, in particular:

1.1. Increase or remove the limit on investments in foreign assets, so that the management determinesthe share of foreign assets in investment portfolio.

It should be noted that even within the limits of existing investment opportunities, the Pension Agency can take higher risks. For example, according to the current law, in a less risky portfolio, up to 20% of assets may be placed in foreign currency, including equity securities (shares). If the assets to be placed in foreign currency are fully directed to the purchase of shares or other relatively high-risk instruments, it will be possible to increase the returns. However, from August 2023, the law will already allow high-risk placements, which will make it possible to increase the yields of medium and high-risk portfolios. Starting with the same period, it is important to change the volume of pension assets placed in deposits, which is 59.8% at the moment. None of the countries selected/assessed by us have placed such a high volume of pension assets in bank deposits.

The main advantages of investing in the assets of foreign companies are:

- The opportunity to diversify investments;

- High yields (risk-discounted);

- Companies that, do business in countries with stable economies, unlike that of Georgia, indirectly create an opportunity to import the results/potential there to Georgia.

1.2.The Agency should be given more flexibility in setting limits for placement in low-risk, medium-risk, and high-risk assets to reflect the changing situation, such as, for example, bonds being considered relatively less risky assets. This is reason the funds of people approaching the retirement age are mainly placed in bonds, even though they can also carry some risk. For example, since January 2022 in the USA, the value of the investment portfolio has decreased by 17%, and the 10% inflation has further reduced the amount of the annual pension.

Giving preference to one instrument, such as investing primarily in bonds or bank deposits, especially in the face of rising inflation, cannot ensure stable real yields and a "decent" pension at retirement age.

Not only that, but traditional portfolios of stocks and bonds are no longer as efficient as they once were. The main challenges facing pension funds around the world are a low level of diversification, rising inflation, and declining real incomes. Pension funds are struggling to achieve planned returns, and investors are asking for investments in novel and potentially riskier products. Obviously, fund managers assess these requirements in the context of their obligations. Faith in the pension system can be undermined not only by specific facts of payment delays/less than expected returns, but also by mere assumptions and doubts. These delays/reductions can occur due to both increased and decreased risk-taking.

To cover potential yield shortfalls and unfunded liabilities, pension funds choose to invest in higher-risk instruments, such as digital assets and their supporting infrastructure. According to the investor confidence survey, 94% of state and government pension schemes, 62% of corporate-defined benefit (DB), schemes and 48% of corporate-defined contribution (DC) schemes stated that they invest in cryptocurrencies.

In the interest of fairness, it should be mentioned that many pension asset managers refrain from investing in cryptocurrencies, although they make this decision based on their own research and not on the basis of subjective attitudes. For example, Canada's largest pension fund, CPP Investments, based on its own research on investment opportunities in the volatile crypto market, decided that it would not invest directly in cryptocurrency. Four Swedish public pension funds, meanwhile, have invested more than 200 million Swedish kroner ($19 million) in the cryptocurrency trading company Coinbase, which lost 87% of the value of its shares.

- Prepare a decision to stop the provision of social (basic) pension for participants of the funded pension system if their savings exceed a certain threshold. There will come a time when the majority of basic (social) pension recipients will be simultaneously beneficiaries of the funded pension system, while those who remain in the basic (social) pension scheme will be the people who voluntarily withdrew from the funded pension scheme (currently, 170,111 employees). The state has a reduced obligation towards those who have withdrawn. The main purpose of the funded pension system is to reduce the burden on taxpayers. Giving an additional social pension to the participants of the funded pension system will make it impossible to achieve this goal.

- Determine the period from which the increase of the social (basic) pension, including through indexation, will be stopped. By January 1, 2019, when the funded pension system came into force, people who had already reached retirement age could not join the scheme. The state has an obligation towards these people. However, there will come a time when the majority of basic (social) pension recipients will not be the people who could not join the funded pension scheme due to their age, but those who withdrew from the funded pension scheme. For these recipients, the continuation of the increase of the basic pension, as we mentioned above, will be a completely unjustified burden, especially since the majority of them consciously opted out of the funded pension scheme in anticipation of their own self-sufficiency in the future.

The two main justifications for the funded pension system are that:

- The basic pension should increase at a lower rate under the funded scheme than without it, and therefore put less of a burden on taxpayers. 3.38 billion GEL is spent on pension provision in 2023, which is 21% of expenses. Carrying this burden significantly hinders the development of the country.

- The country has not had a culture of saving

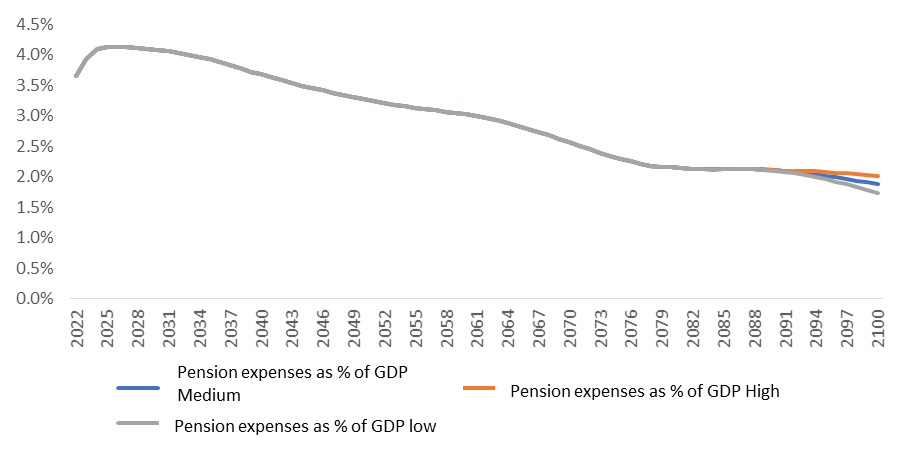

It should be noted that according to the pension cost modeling found in the 2023 state budget fiscal risk document of the Ministry of Finance, despite the increase in GDP, the ratio of basic pension to GDP will remain around 3.9% from 2022 to 2034, which will be a heavy burden on the economy.

Figure 9: Ratio of basic pension expenses with the GDP

Against the conditions of the existing scarce fiscal resources, the significant increase in the number of pensioners in Georgia and, accordingly, the share of pension expenses in the budget significantly hinders the focus towards the country's development.

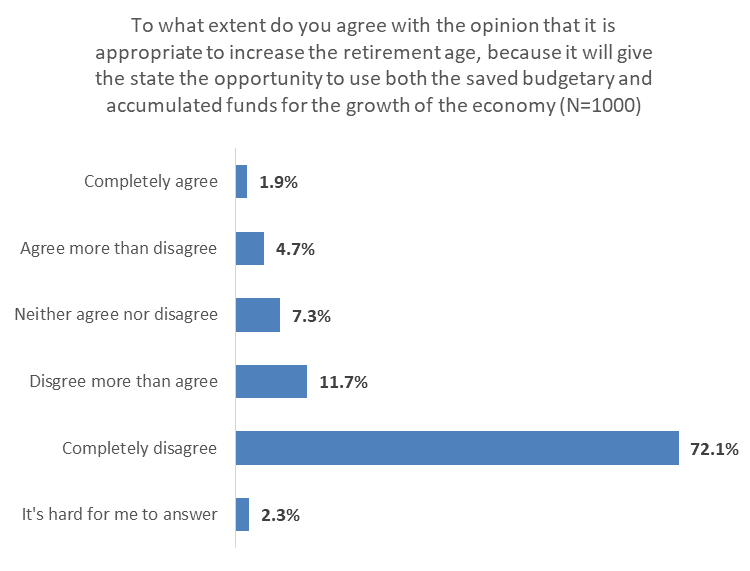

The increase in the retirement age in Georgia does not elicit as much resistance as in some other countries. For example, according to the survey of the Institute for Social Research and Analysis regarding the population's attitudes on the reform of the pension system, the question of how appropriate it is to increase the retirement age, which will give the state the opportunity to use the saved budgetary funds, as well as the funds accumulated by the citizens, 27.9% of respondents do not oppose raising the retirement age, and 72.1% categorically oppose it, while, for example, a much larger part of the population in France opposes Macron's pension reform, which entails an increase in the retirement age from 62 to 64 years.

Figure 10: Attitude of the population towards the pension system reform

Financing investment in infrastructure is, in essence, the job of banks. Where governments take such risks, they also assess the potential harm that such decisions may bring. Pension asset managers are strongly opposed to investment ideas dictated by public policy objectives, e.g. the UK government's decision to shift billions of pounds of pension savings into long-term investments such as start-ups and infrastructure, i.e. illiquid assets. It is worth noting that pension savings are more often invested in infrastructure by corporate pension schemes. For example, Liechtenstein’s defined benefit pension funds can invest 30% of assets directly in real estate, and 10% in foreign (outside the European Economic Area and Switzerland) real estate.

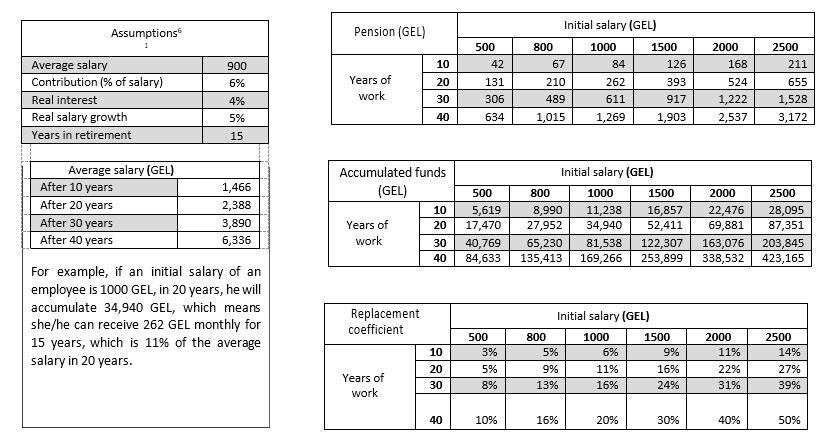

Table 5: Modeling pension benefits

Note: The above calculations are based on 2015 average monthly nominal salary, which was 900 GEL. According to Geostat data, in 2022, in the 4th quarter, the average monthly nominal salary in Georgia amounted to 1,773.7 GEL, although according to the data, in 2021, the median salary of hired employees was 900 GEL, which is the same as the 2015 average monthly nominal salary. Therefore, the calculation of accumulated funds is still relevant.

-----------

[1] https://www.im.natixis.com/sg/research/2022-global-retirement-index#:~:text=Now%20in%20its%20tenth%20year,retirement%20security%20around%20the%20world.

[2] Norway, Switzerland, Iceland, Ireland, Australia, New Zealand, Luxembourg, Netherlands, Denmark, Czech Republic.

[3] As of February 28, 2023, the net value of pension assets amounted to 3.14 billion GEL, 80% of which should be invested in Georgia.

[4] https://back.pensions.ge/uploads/docs/investment-activity/monthly-reports/2023/Monthly_Performance_Report_GEO_28_02_2023.pdf

[5] As shown in the graph below, the difference between net nominal return and inflation is 4.9%, which, after accounting for the real rate, comes down to 3.56%.

[6] Source: Pension Agency, Institute for Development of Freedom of Information

[7] Represents the ratio between pension and average salary

[8] The Netherlands to raise retirement age to 67 years and 3 months

[9] https://www.oecd-ilibrary.org/docserver/pension_glance-2017-10-en.pdf?expires=1676535433&id=id&accname=guest&checksum=63B62BAFA460B7779B46C5015DA64953

[10] https://www.economist.com/europe/2023/03/09/france-is-in-a-stand-off-against-emmanuel-macrons-pension-reform

[11] https://www.schroders.com/sk/insights/economics/world-pension-ages-on-the-rise-when-will-you-retire/

[12] change the pension rules to encourage more early retirees back to work. https://www.theguardian.com/politics/2023/feb/14/uk-labour-market-stagflation

[13] Source: Geostat, Institute for Development of Freedom of Information

[14] Source: Ministry of Finance of Georgia, Institute for Development of Freedom of Information

------------

/public/upload/Analysis/Pension-Reform-Report eng .pdf

This material has been financed by the Swedish International Development Cooperation Agency, Sida. Responsibility for the content rests entirely with the creator. Sida does not necessarily share the expressed views and interpretations.